Litecoin (LTC) Battles $80: A Critical Test for Its Market Stability

- byAdmin

- 15 May, 2024

- 20 Mins

Introduction

What's up, crypto enthusiasts? Welcome to today's deep dive into Litecoin (LTC) as it faces the herculean task of conquering the $80 price level. If Litecoin were a soap opera, this would be the cliffhanger moment! Thanks to Bitcoin showing some weakness, LTC is currently dancing around that critical support line. Let’s dig into the price trends, metrics, and what could come next for this digital silver to Bitcoin’s gold.

Current Price Analysis

LTC's Struggle with the $80 Resistance

So here we are, with LTC sparring at the $80 mark like a boxer on his last legs but unwilling to throw in the towel. The price currently hovers just below this key threshold, creating nail-biting moments for investors. The situation is getting as tense as the last cookie at a family picnic. If LTC dips below $75, we might be in for a waterfall of liquidations which would drag the price further down. This sort of action is reminiscent of a dramatic soap opera plot twist but on a digital stage.

The $80 level aligns snugly with the Ichimoku Cloud, which is essentially the weather forecast for crypto traders. If LTC closes below this cloud on the 4-hour chart, expect stormy weather ahead. We could see a slide down to $75 faster than you can say, "HODL!" On the flip side, should LTC break and hold above this cloud, it might signal a plot twist in our favor, indicating a potential uptrend. Talk about a roller-coaster ride!

Importance of Fibonacci Retracement Level

Ah, Fibonacci retracement levels—the magical numbers that seem to predict price movement more accurately than your GPS does directions. Right now, the 0.618 Fibonacci level is the bread and butter for LTC holders. Sitting comfortably at the $80.37 mark, this level is a key linchpin for the coin. Think of it as the floor on a bouncy castle; once it gives way, everyone’s tumbling down.

If we see Litecoin plummeting past this point, it might as well be wearing concrete shoes in a river. Expect increased volatility, which is basically a fancy way of saying "brace yourself for some wild price swings." But hey, volatility also means opportunity! Traders might see this as a golden ticket to scoop up more LTC at discounted prices, waiting for the next bullish wave to ride. Why buy Litecoin at $80 when you might get it for $70, right? Then again, play it safe; a stop-loss at $68 could prevent your portfolio from looking like it's been through a shredder.

Historical trading data

In the wild, wild world of cryptocurrencies, Litecoin (LTC) often finds itself in intriguing predicaments. The current saga circles around its wrestling match with the $80 support level—a drama that has market participants biting their nails. But what does the historical trading data tell us about this situation?

Alright, let’s roll up our sleeves and dive into the charts. Historically, LTC has shown a pattern of sticking around significant support levels before making decisive moves. The 4-hour Ichimoku Cloud analysis sheds light on recent price actions, highlighting the spectral appearance of colorful support and resistance zones.

Red lines on these charts act like battle scars—etched deeply to remind traders of hard-fought levels. Regardless of whether the price hovers around $79 or takes a trip below $75, there's a critical trading zone that has historically set off cascades of liquidations. It is much like an old fortress witnessing numerous battles, each skirmish revealing its own story.

Beyond the charts, we have Litecoin's on-chain activity offering whispers of market sentiment. The technical indicators from historical trading data scream (well, analytically murmur) about the importance of holding certain thresholds. If LTC falls below $75, brace yourselves for a rollercoaster packed with volatility and potential market corrections.

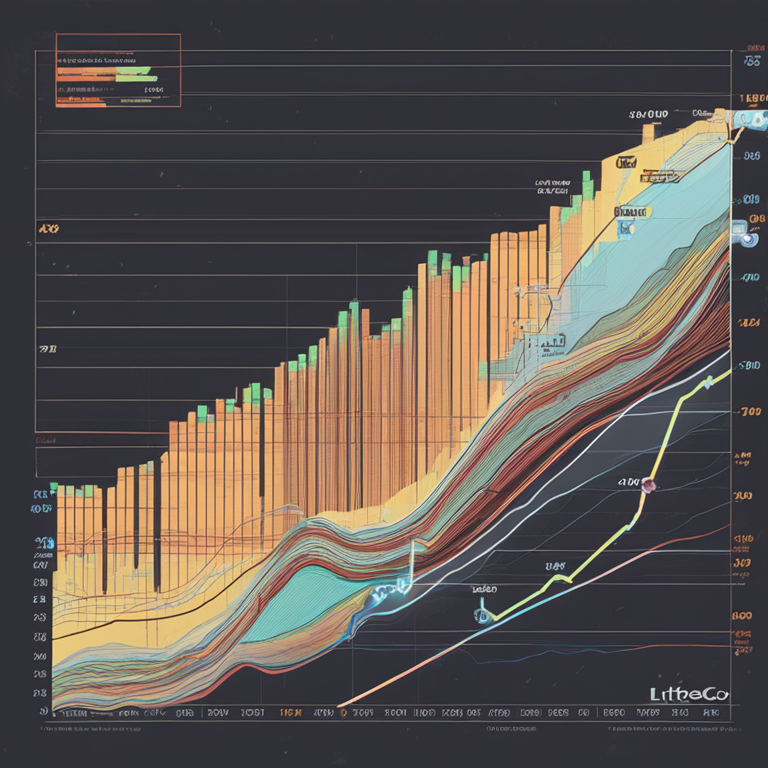

Spent volume by age bands

Imagine the market as a bustling antique store, with items being swapped, sold, and admired at different rates. This analogy fits well when analyzing spent volume by age bands for LTC. From the green bars representing short-term holdings to the ominous red bands indicating longer-term holds, the charts present an enthralling tableau of buying and selling behaviors.

The superstars on this stage are the green bars, as they capture the majority of volume. It's as if the lightweight contenders—those holding LTC for 1 hour to 24 hours—are leading the charge in a rapid techno-dance of trading activity. With an average daily volume of around 800K LTC, these short-term holders deserve a standing ovation for their boisterous participation.

Amidst this vibrant performance, the black line sketches the LTC price in USD. Like a stern conductor guiding an orchestra, the black line emphasizes critical moments where volume spikes translate to significant price movements. It’s a constant reminder of the interplay between spent volumes and market impacts.

Our aged participants in the red bands (1 to 3 months) also play a crucial role. Their strategic sell-offs often hint at larger market sentiments—think of them as experienced veterans deciding when to leave the battlefield. Their sell-offs around May 10 signified a noteworthy shift, churning the market's waters and echoing changes in sentiment or attempts at profit-taking.

Investor sentiment and behavior

When it comes to the kingdom of Litecoin, investor sentiment carries the weight of a thousand coins. From mid-term holders to last-minute Larrys, every trader’s decision shapes the market’s pulse. So, what's the latest buzz?

Let’s talk about mid-term higher-ups selling off their LTC holdings. When these veterans start unloading their coins, it’s more than just a mood swing—it’s a seismic shift. Their sell-offs often align with market patterns indicating a shift in investor sentiment or a strategic exit.

Piece together their moves, and you get a tapestry of behavior that’s not just reactive but often predictive. For instance, holding periods ranging from one month to three months can signal potential market corrections, and a significant uptick in this activity usually heralds a price dip.

What’s intriguing here is the dance between fear and greed. Short-term traders, like rabbits in a field, are more skittish and quicker to bolt at the scent of volatility. These behaviors create ripples in the market’s tranquil pond, affecting stability. Meanwhile, longer-term holders exude the cool demeanor of tortoises, reshaping the market more subtly but decisively with their substantial holdings.

Mid-term holder sell-off

The saga continues with a focus on mid-term holders sitting in the red zone of our age bands. Have you ever watched a veteran chess player make a move? That’s akin to these mid-term holders selling their assets. On May 10, their significant sell-off was like a chess player aggressively moving their queen—a move that shook the board.

Such a sell-off generally signals a ruffling of the market’s feathers. This can stem from a need to realize profits or simply a shift in strategy. Either way, it impacts market sentiment, often inducing a domino effect among other holders who might follow suit. These calculated exit strategies impact not just LTC but ripple through the broader crypto market.

For those following the market closely, such moves offer critical insights—like a weather forecast for traders. Noticing a spike in mid-term sell-offs? Time to review your strategy and maybe tighten those stop-losses. Observing a lenient phase? Perhaps it's an opportunity to enter at lower levels.

It’s a literal game of thrones in the cryptosphere, where every sale, hold, and buy turns the tides. As mid-term holders adjust their sails, the rest of the fleet must navigate the new currents while keeping an eye on these seasoned navigators.

Impact on price stability

Sometimes, the market feels like riding a rollercoaster with no safety bar, especially when significant sell-offs by mid-term holders happen. Their sudden moves can turn a smooth ride into a stomach-churning drop.

When these sell-offs peak, the market shivers, and the resulting impact on price stability echoes across the trading floor. Imagine trying to surf on rough seas—unpredictability reigns supreme. Even short-term traders, agile as they may be, find their footing wobbly during such volatile spells.

But it's not all doom and gloom. Price stability, or the lack thereof, provides opportunities for astute traders. Recognizing patterns amidst the chaos can be profitable—think of it as finding calm waters amidst a storm. Strategic decision-making becomes the beacon guiding traders through the fog.

At the end of the day, everyone in the cryptosphere—from the daredevil day trader to the strategic long-term investor—plays a part in this elaborate ballet. Each movement, each decision, feeds into the grand narrative of Litecoin’s market journey. Fasten your seatbelts, folks; it’s thrilling, it's unpredictable, and above all, it's Litecoin.

Future price projections

Alright folks, grab your digital popcorn because we're diving deep into the world of Litecoin, otherwise known as the silver to Bitcoin's gold. As of late, the price of LTC is hitting that awkward $80 mark like a reality show contestant trying to figure out if their moment in the spotlight is a breakthrough...or a breakdown. We're talking a critical support level here, one that could send ripples—or tidal waves—through the market. So, let's stroll through the world of Litecoin's potential future price projections, shall we?

Bearish to neutral outlook

Starting off with the glass-half-empty (or maybe just cracked) perspective: Litecoin's price seems to be playing a game of limbo, with $80 giving it a serious side-eye. If LTC keeps struggling under this level and Bitcoin continues to pull a "nah" at the $61,000 mark, LTC could be in for a rough ride. Think of it like trying to sail with a torn sail – not impossible, but definitely tricky. This bearish to neutral outlook could spook holders, causing short-term traders to jump ship faster than you can say "FOMO."

Strategies for risk mitigation

So you've managed to keep your cool while navigating these choppy financial waters. Kudos! Now, let's talk strategy, because even Captain Jack Sparrow knew when to batten down the hatches. If BTC drops below $61,000 and LTC slips under $75, it's time to consider mitigating your risks. Seriously, grabbing that life vest—aka a stop-loss at $68—could save you from a financial Titanic moment. Ideal entry points could be around $70-$72, allowing you to set sail for higher peaks. Look to cash out between $85 and $90 for some smooth sailing ahead.

Conclusion

Whether you're eyeing the bearish or more neutral lane, being savvy about these projections can guide your sails. By weaving strategic decisions into your financial fabric, you can tilt the odds in your favor. Remember, the key to navigating cryptocurrency waters is risk mitigation and smart entry points. Happy trading, and may your Litecoin journey be smooth and prosperous!

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.