Bitcoin Has Best Day in 2 Months as Markets Anticipate a ‘Summer of Easing'

- byAdmin

- 16 May, 2024

- 20 Mins

Introduction

Hold on to your digital hats, folks! Bitcoin just had its best day in nearly two months, putting the rest of the financial world on notice. Like an underdog athlete returning from the brink, the cryptocurrency roared back to life with a dramatic 7.5% surge. But what’s behind this rapid rebound? Let’s dive deep into the crypto waves to decode the reasons for this impressive performance and what it means for the broader market.

Bitcoin's Market Performance

Bitcoin (BTC) posted its biggest single-day gain in almost two months, igniting enthusiasm among traders and investors alike. According to both TradingView and CoinDesk data, the premier cryptocurrency surged over 7.5%, topping out at a crisp $66,250. This noteworthy spike marks Bitcoin's most substantial rise since the stirring days of March 20, when everyone was anxiously watching the screens—a bit like a nail-biting season finale!

The catalysts? Weak U.S. economic data hinted that the Federal Reserve might have to cut interest rates in September. This potential pivot aligns with a broader trend among global central banks toward easing monetary policies. The Bank of England (BOE) and the European Central Bank (ECB) are also likely on the verge of rate cuts come June, reinforcing a rallying cry for risk assets like cryptocurrencies. Essentially, when borrowing costs are expected to drop, assets like Bitcoin start to get all the love.

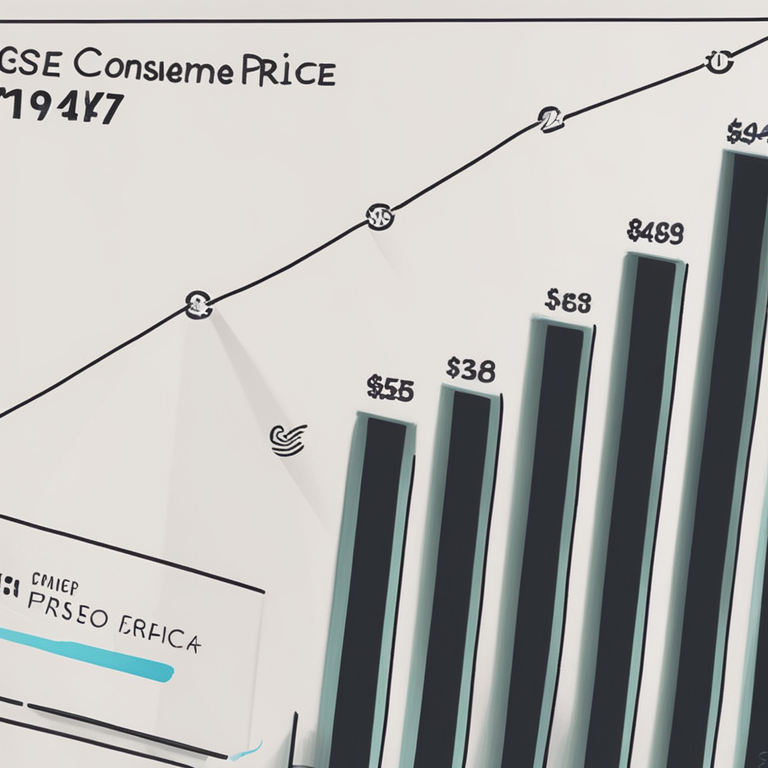

The U.S. Labor Department's latest Consumer Price Index (CPI) data added fuel to the fire. The CPI rose by a modest 0.3% in April, a slower pace than anticipated, suggesting that living costs are easing. Coupled with underwhelming retail sales data, this scenario has created an environment ripe for potential rate cuts. Future markets are now betting that the Fed will execute a 25 basis point cut in September—cue the summer rate cut party!

It’s not just the Fed joining the rate-reducing revelry; central banks across the globe are aligning in a synchronous dance of easing policies. This collective move could spell an uptick in liquidity and a green light for investments in riskier assets, including our aforementioned digital gold, Bitcoin. Data from MacroMicro underscores this, showing a growing proportion of central banks making rate cuts their latest move.

To sum it up, this potential rush of liquidity is like giving the financial markets a refreshing brand of summer fizz, encouraging investors to remain further out on the risk curve. As you soak up the rays, keep an eye on the horizon because Bitcoin, buoyed by rate cut anticipations, might just continue its sizzling streak.

Economic Indicators Influencing Bitcoin

U.S. Economic Data

If you've been keeping an eye on Bitcoin lately, you might have noticed it had its best day in two months, rising over 7.5%! If you're wondering why, it’s not just good vibes or a moon cycle. Nope, it's a little more down-to-earth — it's all about economic data and central bank policies. Let's dive into the mix of U.S. economic signals that have been making Bitcoin do the happy dance.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is one of those fancy terms economists throw around, but it's basically just a measure of inflation. Recently, the U.S. Labor Department reported that CPI numbers for April came in lower than expected. Headline CPI increased by just 0.3%, less than in March and February. Well, this might sound like a boring math class, but for Bitcoin, it was like winning the lottery.

When inflation is lower, it makes the Federal Reserve more likely to cut interest rates. Why? They’re aiming to make borrowing cheaper, so people and businesses spend more, theoretically boosting the economy. When traders smell the scent of potential rate cuts, they get excited and start shopping spree in risky assets — like Bitcoin!

Retail Sales Growth

Retail sales data also threw some spice into the Bitcoin mix. In April, retail sales growth didn't just slow down; it practically came to a halt, especially in the "control group" category that influences GDP calculations. Retail sales in this group declined by 0.3% month-on-month. Now, why does this matter for your digital coins?

These weaker retail sales numbers add more weight to the argument for rate cuts. When the economy shows signs of slowing down, central banks are more likely to lower interest rates to give it a jolt. So, once the retail sales data came out, the probability of a summer rate cut seemed more likely—and Bitcoin traders could hardly contain their glee.

Expectations of Central Bank Policies

Federal Reserve (Fed)

When it comes to central banks, the U.S. Federal Reserve is like the godfather of them all. Recently, the Fed signaled that it's slowing down the pace of its quantitative tightening starting in June. Quantitative tightening is a fancy way to say "making it harder to borrow money." Cutting down on this can be music to the ears of Bitcoin traders because easier money means more liquidity in the market.

Fed funds futures now show traders are expecting a 25 basis point rate cut in September. Sip on that iced coffee, because if this happens, it'll be smack dab in the middle of what traders are calling a 'Summer of Easing.' It's like summer vacation—but for markets. Hooray for that!

Bank of England (BOE)

Across the pond, the Bank of England (BOE) is also showing signs of joining the rate cut party. Markets are betting on rate cuts as early as June. Imagine the UK central bank as that friend who shows up at a party and makes everyone even more excited. Rate cuts by the BOE would make borrowing cheaper, just like in the U.S., and this could buoy risk assets like Bitcoin.

So, if you've got a map, you can start coloring the UK in bright Bitcoin orange, because the BOE's potential rate cuts are like adding another layer of sprinkles to an already delicious market sundae.

European Central Bank (ECB)

Let's scoot over to mainland Europe, where the European Central Bank (ECB) is also getting in on the action. Markets expect the ECB to cut rates in June, following similar patterns to their counterparts in the U.S. and the UK. Is it getting a bit easier to see why Bitcoin had such a great day?

With a trifecta of central banks showing signs of easing, the market is basically setting up a runway for Bitcoin's next moonshot. Easier monetary policies generally mean better liquidity, which is a fancy way to say there's more money floating around. And more money floating around means people are more likely to put it into various assets, including our beloved Bitcoin.

Swiss National Bank (SNB)

Switzerland's central bank, the Swiss National Bank (SNB), has already reduced its benchmark borrowing costs. Imagine the SNB as the proactive student who always turns in their homework early. By cutting rates ahead of others, Switzerland signaled that it’s all-in on supporting its economy, and that has positive implications for assets around the world.

When SNB cuts rates, it decreases the cost of borrowing Swiss francs, making it easier for investors to take risks. This kind of early action also sets a tone that other central banks might follow, making the entire global financial landscape more favorable to riskier assets like Bitcoin.

Sweden’s Riksbank

Last but not least, we’ve got Sweden’s Riksbank, which has also already reduced its rates. Again, think of Riksbank as another member of the early bird club. Lower interest rates in Sweden make krona borrowing cheaper, encouraging investments in higher-risk assets — yep, Bitcoin included.

So, as you sip on your lingonberry juice, know that Sweden’s steps towards easing financial conditions contribute to a more global trend of rate cuts. It’s like the world’s central banks are doing synchronized swimming, and Bitcoin is catching the wave.

Global monetary easing trend

Hold on to your virtual wallets, folks! Bitcoin just scored its best day in nearly two months, skyrocketing over 7.5% in a single day. This impressive surge has folks buzzing and it's all thanks to some much-anticipated monetary easing from central banks worldwide. It seems like those old financial wizards decided to throw a bone at risk assets, including our beloved BTC, and the markets are singing their praises. For those tuning in to the financial forecast, it looks like we’re gearing up for a “Summer of Easing”. Get your sunglasses ready, because this summer might bring some financial shine!

The nitty-gritty goes like this: The U.S. Labor Department recently dropped some data that practically screamed, "Hey, Fed, it’s time for a rate cut!" The consumer price index (CPI) didn’t rise as much as expected in April, signaling a cooling trend in the cost of living. This coupled with headlines that retail sales growth hit the snooze button has investors expecting the Federal Reserve (Fed) to slice off a wee bit from interest rates come September. Imagine the Fed as the financial barber, trimming just enough off the top to keep our economic coif stylishly in place.

But hold the phone, it’s not just Uncle Sam’s crew getting in on the rate-cutting action. Across the pond, both the Bank of England (BOE) and the European Central Bank (ECB) are gearing up to trim those pesky rates in June. The Swiss National Bank (SNB) and Sweden’s Riksbank already jumped on the bandwagon, lowering their benchmark borrowing costs. It’s like a central bank concert, with each one playing the sweet melody of lower rates.

All this rate-cutting action is a big thumbs up for risk assets like bitcoin. Cryptocurrencies are the high-energy rockstars of the financial world, and when central banks make money cheaper, these assets tend to party harder. Data from MacroMicro showed a rising percentage of global central banks are now cutting rates. According to MacroMicro, "The higher the proportion goes, the more central banks are cutting rates, which could help improve market liquidity." Simply put, a more liquid market means better times for assets on the risk curve.

It’s not just the numbers talking—brokering firm Pepperstone chimed in, saying that the potential increase in market liquidity over summer should keep investors feeling adventurous. This means they're more likely to stick with or invest more in riskier assets like equities and, you guessed it, cryptos. If the “Summer of Easing” comes to pass, it just might pour a refreshing rain of financial goodies over the summer markets. Keep those HODLing hands steady and your eyes on the crypto horizon!

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.