Biden Order to Halt China-Tied Bitcoin Mine Beside Nuke Base Came as U.S. Firm Just Bought it

- byAdmin

- 16 May, 2024

- 20 Mins

Introduction

Well folks, it seems President Biden has thrown a wrench into the gears of the latest Bitcoin mining saga. CleanSpark, an American bitcoin mining company, was all set to dive into new crypto riches when the White House tipped the scales. In a plot twist that feels like it’s out of a suspense novel, the newly minted U.S. owners were informed that the operation posed a national security threat. Grab your popcorn, because we’re unpacking this latest crypto drama!

Background

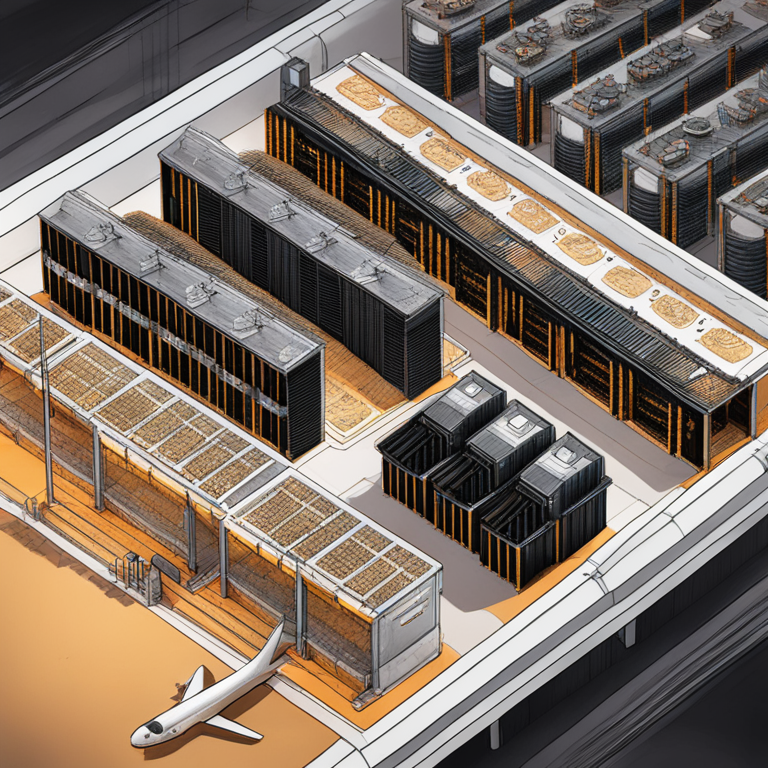

CleanSpark recently announced its acquisition of two mining sites in Wyoming for a cool $19 million. These sites, previously owned by MineOne, a company with Chinese affiliations, sit uncomfortably close to Warren Air Force Base—home to the Minuteman III intercontinental ballistic missiles. Yeah, you heard that right, folks. We’re talking about nukes and Bitcoin in the same sentence. MineOne, primarily owned by Chinese nationals, had been under scrutiny for its connections. Little did CleanSpark know that their new asset would soon become ground zero for a national security showdown.

Despite this looming tempest, CleanSpark seemed blissfully unaware. The company was ready to tap into China-based Bitmain's fancy new mining machines and ramp up their operations by a hefty 55 megawatts. The ink on the $19 million deal was barely dry before the presidential order came crashing in. What’s more, the order taps into the expanded presidential powers granted by the Foreign Investment Risk Review Modernization Act of 2018—a mouthful, I know, but stick with me. CFIUS (that's the Committee on Foreign Investment in the United States for those keeping score) swooped in, declaring the site a ghost town with immediate effect.

Details of the Biden Order

The plot thickened when Biden’s executive order explicitly identified MineOne’s technology as foreign-sourced—code for “potentially naughty.” The directive mandated that all mining equipment within a mile of the military site in Cheyenne be packed up and shipped out. The order wasn’t just a suggestion; it was a stern directive with national security stamped all over it, pointing a glaring finger at the risks of having Chinese-owned tech so close to American nukes. After all, it’s not every day you mix crypto mining with missile silos!

CleanSpark was left in a bit of a pickle. With no knowledge of the looming governmental ban, they were blindsided. However, the company didn’t just roll over. They acknowledged the security concerns flagged by the executive order and conveyed their unwavering intent to navigate these choppy waters. Their spokesperson’s pitch-perfect reaction? “We didn’t see this coming, but we’re ready to tango.” How’s that for resilience?

The involvement of CFIUS here isn’t trivial. Historically, seven out of eight cases involving CFIUS’s heavy-handed intervention had China’s fingerprints all over them. This case isn’t bucking that trend. Anne Salladin and Brian Curran from Hogan Lovells chimed in, indicating that this is a landmark case, a first under the beefed-up powers accorded to the president and CFIUS by the 2018 act. This situation is a classic case of real estate meets geopolitical chess. And let's face it, CleanSpark’s willingness to wade through this mucky business might spell a “win-win” for U.S. interests and the company.

In a nutshell, President Biden's executive order marks an unprecedented exercise of authority over real estate transactions tied to national security. CleanSpark, ever the tenacious miner, is chasing the light at the end of this labyrinthine tunnel. What we’re witnessing isn’t just a pause in crypto mining; it’s a dramatic confluence of technology, national security, and international politics. Stay tuned for the next chapter in this saga, because the stakes are sky-high.

CleanSpark's acquisition

Boy, talk about bad timing! CleanSpark (CLSK), an American bitcoin mining company, probably didn't expect to get caught in the middle of a U.S.-China whirlwind after buying bitcoin mining sites in Wyoming. Just when they were popping the champagne for their nearly $19 million acquisition from MineOne, the White House decided to drop a bombshell—literally and figuratively—on them. President Joe Biden issued an executive order to halt operations at the newly acquired site, citing concerns over national security. Mind you, MineOne, the seller, has significant Chinese ownership, and the purchase was only finalized mere days before the presidential order. It's as if CleanSpark accidentally wandered into a high-stakes geopolitical chess game and expected to just mine some bitcoin.

National security concerns

So, why all the fuss? Well, here's the kicker: the bitcoin mining facility is sitting pretty close to Warren Air Force Base in Cheyenne, Wyoming—home to Minuteman III intercontinental ballistic missiles. Yes, missiles! President Biden's order pointed out that MineOne owns the majority of Chinese nationals and employs foreign-sourced technology, ringing all kinds of alarm bells. Imagine being CleanSpark, thinking you've scored a sweet deal, only to find out you're mining bitcoins right next to a key U.S. military site. Security experts, and probably a few sleepless military personnel, weren't exactly thrilled with this proximity. Therefore, all mining equipment had to be removed from within a mile of the base, essentially turning CleanSpark's mining dream into a logistical nightmare.

CFIUS and legal aspects

This saga wouldn't be complete without talking about CFIUS—the Committee on Foreign Investment in the United States. CFIUS has historically acted as the gatekeeper against foreign investments that could jeopardize U.S. security. According to the executive order, CFIUS's powers were used to nix the acquisition, citing the Foreign Investment Risk Review Modernization Act of 2018. This isn't CFIUS's first rodeo; it's the eighth time CFIUS has stepped in to shut down deals involving Chinese owners, emphasizing just how serious this committee is. CleanSpark's spokesperson acknowledged the unexpected hiccup and reaffirmed the company's plans to respect the oversight process. One of the company's board members, Tom Wood, who has a rather impressive resume involving national security, called the CFIUS process "impartial, data-driven, and non-arbitrary." So, while CleanSpark navigates these choppy waters, it's clear they're not down and out yet. Instead, they appear committed to turning this into a "win-win" situation—if they can address the security concerns, that is.

Responses and Statements

So here's a juicy one for you: CleanSpark, the American bitcoin mining giant, has found itself smack dab in the middle of a U.S.-China power play. Picture this: the company just bought mining sites in Wyoming from MineOne, a firm with Chinese ties, and bam—President Biden orders the mining operations near Warren Air Force Base to halt, citing a national security threat. You couldn't script this any better if you tried.

CleanSpark says it had no idea about the impending executive order when they signed on the dotted line and they're determined to plow ahead with the acquisition regardless. They must have felt like they were suddenly playing a game of Minesweeper where clicking the wrong square just blew up their well-laid plans.

A CleanSpark spokesperson emphasized that they respect the oversight process and are committed to making sure their operations contribute to national security. They even threw in a bit of local pride, highlighting Wyoming's pro-Bitcoin stance, which must have given a warm, fuzzy feeling to anyone from the Cowboy State reading it.

The drama doesn't stop there, folks. MineOne's involvement went deep, with major stakeholders like Jiaming Li, who has a resume that reads like a James Bond villain's LinkedIn—managing billions at Sinatay Insurance Co., heading up China Xiangtai Food Co., and briefly even being the president of Bit Origin Ltd. None of them were available for comment, probably off somewhere twirling their mustaches (or whatever the digital equivalent of that is).

CleanSpark's board member Tom Wood, who's been knee-deep in national security affairs for four decades, pointed out the obvious: having a CCP-owned data processing facility near crucial defense infrastructure is a security no-no. He described the CFIUS process as "impartial, data-driven, and non-arbitrary,” which sounds exactly like how you’d want your favorite reality TV judge to behave.

And just to add more layers to this geopolitical lasagna, Anne Salladin and Brian Curran from Hogan Lovells chipped in to say this is the first time the expanded authority over real estate transactions granted to CFIUS and the president is being used under the Foreign Investment Risk Review Modernization Act of 2018. It’s like watching a chess game where both players keep changing the rules every five turns.

All in all, it's a high-stakes saga set against the backdrop of Bitcoin mining, international intrigue, and legalese so dense it could function as a paperweight. The question now is, will CleanSpark navigate this minefield successfully, or will they find themselves another victim of geopolitical chess? Only time (and several legal reviews) will tell.

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.