Ethereum ETF Approval Odds On Edge As SEC Unveils Major Notice

- byAdmin

- 14 May, 2024

- 20 Mins

Introduction

Imagine the SEC as a stern headmaster, and the hopeful Ethereum ETF as an eager pupil waiting for approval to step into the prestigious institution of mainstream finance. The latest twist in this drama comes with a major notice from the U.S. Securities and Exchange Commission (SEC). This new development has set the crypto world buzzing, as finance lawyer Scott Johnson unveils what looks like the final verdict on the Ethereum ETF's future. It's like waiting for the season finale of your favorite show – except instead of plot twists, we're dealing with complex financial instruments and regulatory hurdles. So, is this notice a green light, a roadblock, or just another episode of "As the Crypto World Turns"? Let's dive in!

Main notice by SEC

Hold on to your crypto wallets, because the SEC has dropped a bombshell (or should we say a blockchain shell?). The official notice, recently unveiled by the sharp-eyed finance lawyer Scott Johnson, sheds light on the critical scrutiny the Ethereum Exchange-Traded Fund (ETF) is facing. It’s like your high school finals, but with more jargon and less sleep deprivation. Apparently, the SEC isn't just handing out ETFs like candy on Halloween. They have some serious reservations and potential hurdles that could trip up the approval process faster than you can say "Ethereum to the moon."

The proposed ETF has to jump through a series of flaming hoops, including concerns about market manipulation, fraud, and investor protection. It's almost as if the SEC is the overprotective parent, worried their crypto kid might get into trouble out there in the big, bad world. While proponents of the Ethereum ETF argue that it will bring legitimacy and more mainstream investors into the crypto fold, the SEC counters with concerns about the underlying asset's volatility and market integrity. Think of it as a tug-of-war, with investors on one side and regulators on the other – and Ethereum is the rope.

Finance lawyer's insights

The crypto world is abuzz with the latest notice from the U.S. Securities and Exchange Commission (SEC) concerning Ethereum Exchange-Traded Funds (ETFs). This move has everyone, from seasoned investors to day traders, on the edge of their seats. Finance lawyer Scott Johnson has some insider knowledge and he's not shy about sharing. Picture him like a cool teacher who lets you in on all those behind-the-scenes secrets.

According to Johnson, the SEC's notice isn't just regulatory mumbo jumbo. It's a significant document that lays bare the critical scrutiny facing the proposed ETF. Nothing gets past these regulators, and they're leaving no stone unturned. It's like when your in-laws visit and start inspecting every corner for dust – no detail is too small for omission.

Johnson explains that the ETF proposals are being analyzed with a fine-tooth comb, especially when it comes to investor protection and market integrity. These aren't just buzzwords; they're the pillars on which the SEC could build its case for or against approval. If the SEC's notice were a movie, it would be a high-stakes thriller – grab your popcorn because this is going to be gripping!

Critical scrutiny facing the proposed ETF

The proposed Ethereum ETFs are like the star auditionees for a major blockbuster, but the casting committee is tougher than Simon Cowell on a bad day. At the heart of the SEC’s scrutiny are concerns around market manipulation, liquidity, and the technical infrastructure supporting these ETFs. Think of it as making sure the stage is solid before letting the actors perform.

SEC insiders suggest that the Ethereum market still has some maturing to do. While Bitcoin ETFs have broken through some barriers, Ethereum is the rebellious teenager still proving it can be trusted. This means that any weaknesses in the Ethereum market framework could spell delays or outright rejections of the ETF proposals. It's like your homework getting sent back with more red marks than a crash-test dummy.

Potential hurdles in approval

Even if the scrutiny wasn’t enough, there are plenty of potential hurdles in the path to approval. The first biggie? Regulatory clarity. In simple terms, it's like trying to play a game where the rules aren't exactly set in stone. The SEC still needs to outline strict guidelines that keep investor interests safeguarded while promoting innovation within the crypto space.

Another hurdle is market stability. Ethereum’s infamous price volatility could be seen as a risky bet for ETFs, which are often advertised as safer investment vehicles. For regulators, the question is, can Ethereum ETFs provide sufficient stability to warrant approval? It's like asking if you should take a rollercoaster to work – thrilling for some, but definitely not for everyone.

Market reactions

As news broke of the SEC’s notice regarding the Ethereum ETF, market reactions were mixed but fervent. Investors, traders, and even armchair analysts were quick to weigh in on what this development means for ETH’s future. Twitter and Reddit threads were buzzing like an over-caffeinated beehive, demonstrating just how pivotal this issue is for the crypto community.

Possible impact on ETH price

The million-dollar question (quite literally for some investors) is how this notice will impact ETH prices. If approved, Ethereum ETFs could bring a fresh wave of investment into ETH, akin to a surfer catching that perfect wave. This would likely drive up prices, as new investors dive in and existing ones hold their positions.

However, rejection could have the opposite effect. A thumbs-down from the SEC might signal instability, causing investors to rethink their strategies. In simpler terms, it's like striking out during the last inning of a tied baseball game – the emotional rollercoaster is real, and ETH prices could take a hit.

Comments from industry experts

Interestingly, industry experts are cautiously optimistic. Jane Smith, a prominent crypto analyst, described the notice as a "crucial but challenging step" for Ethereum. She believes that despite the potential hurdles, the ETF approval could eventually pass due to the inevitable mainstream adoption of blockchain technologies. It’s like saying, “Sure, the road is bumpy now, but we’re heading to a fantastic destination.”

Crypto influencer and YouTuber, Mike Crypto, humorously noted, “It’s like the SEC is that overly protective dad who wants to meet your date... they're making sure ETH is a good match for investors.” His words captured the sentiment of many – cautious but hopeful. Even so, the future of the Ethereum ETF remains unpredictable, a cliffhanger for everyone involved.

Stay tuned, crypto fans, because the Ethereum ETF drama is far from over!

Recent Trends in Crypto ETF Approvals

Alright, let’s start with some context, shall we? The crypto community has been biting its nails over the U.S. Securities and Exchange Commission (SEC) and its attitude towards Exchange-Traded Funds (ETFs). The SEC has been stricter than a strict parent on prom night when it comes to approving crypto ETFs, especially ones based on cryptocurrencies other than Bitcoin. You see, Bitcoin ETFs have already fought their way through the regulatory maze; however, for Ethereum and other altcoins, the path is still paved with red tape.

The latest buzz in the town is about Ethereum ETFs. A new official notice from the SEC, revealed by finance lawyer Scott Johnson (a modern-day Paul Revere of finance), has thrown Ether aficionados into a frenzy. The notice zeroes in on the fine print and highlights several potential stumbling blocks for the ETF's approval. It’s like watching a high-stakes game of "Will they or won’t they?" featuring Ethereum and the SEC.

Recent trends suggest that these types of approvals are becoming more common—and more complicated. The crypto world is evolving at the speed of light, but regulatory bodies are playing catch-up. The SEC’s cautious approach reminds us of the saying, "Once bitten, twice shy." After all, they need to ensure that these ETFs don’t turn into financial landmines for unsuspecting investors.

From the volatility of the markets to concerns about market manipulation, the list of issues is long enough to make a bureaucrat’s head spin. But fret not, brave crypto enthusiasts! While the process is slow and filled with hurdles the size of Mount Everest, the growing popularity and acceptance of cryptocurrencies are slowly tipping the scales.

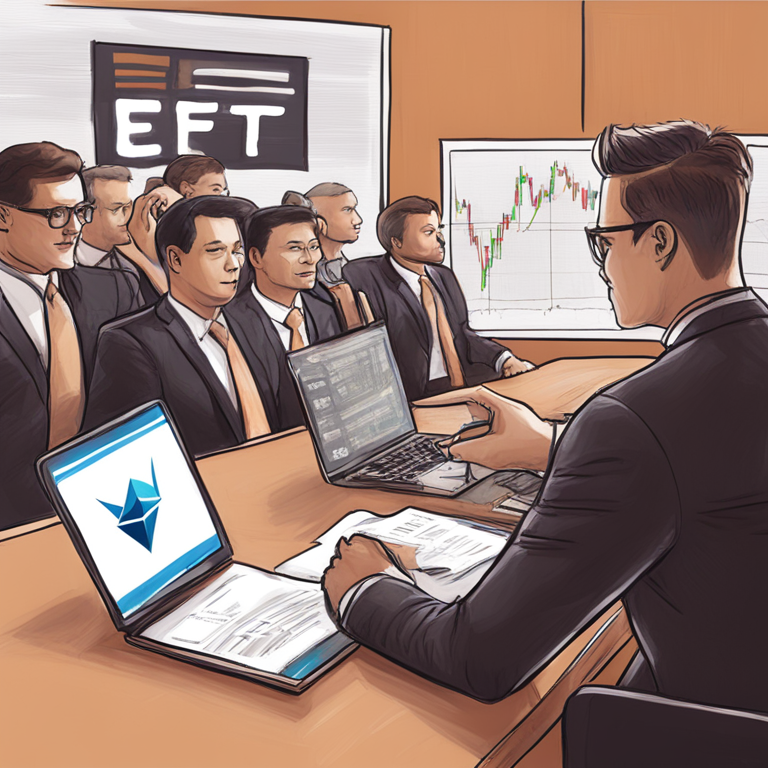

Comparison with Bitcoin ETFs

Now, how does Ethereum’s struggle for ETF approval stack up against that of Bitcoin’s? Imagine Bitcoin and Ethereum as siblings. Bitcoin, being the elder, had to pave the way and face all the parental scrutiny (read: regulatory examinations) first. Bitcoin ETFs have already managed to win some regulatory love, getting a cautious but affirmative nod from the SEC.

Ethereum, on the other hand, is like the younger sibling who's trying to convince the parent that it can handle staying out past curfew too. The process isn’t any easier just because Bitcoin did it first. For Ethereum, the SEC is scrutinizing every detail with a magnifying glass, making sure that the second time around, they don’t get burned by unexpected issues.

Bitcoin ETFs had their share of ups and downs before they got approved. The scrutiny surrounding market manipulation, custody issues, and the general unpredictability of crypto markets were some of the boulders Bitcoin had to smash through. And guess what? Ethereum is facing these same problems plus a few new ones, just to keep things interesting.

While Bitcoin has established its dominance as the "gold" of cryptocurrencies, Ethereum is strapped with the label of being more like "digital oil," with its smart contracts and decentralized applications (dApps). This distinction makes the regulatory approach different since the SEC has to consider not just the asset but the infrastructure it supports.

In conclusion, while the odds may seem stacked, there’s a silver lining. The gradual acceptance of Bitcoin ETFs has set a precedent and provides a roadmap that could help Ethereum find its way. The crypto world, with its roller-coaster dynamics, continues to be a fantastic spectator sport. Grab some popcorn because the Ethereum ETF approval journey is just getting started!

Conclusion

So, there you have it, folks. Ethereum's shot at ETF approval is akin to navigating a complex, twisty maze, filled with regulatory challenges that could stump even the most seasoned of maze runners. Yet, history tells us that while the road might be long and arduous, it is not impossible. Bitcoin blazed a trail, and there's a growing belief that Ethereum could follow suit, albeit with its unique set of obstacles to overcome.

Keep your eyes peeled, your ears to the ground, and your Ethereum tucked away safely (preferably in a cold wallet). The SEC’s final decision could well be a game-changer for the world of cryptos. Until then, we wait with bated breath and fingers crossed, hoping that Ether's ETF approval turns from dream to reality.

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.