Bitcoin in April: Halving Price Fallout, Network Peaks and ETF Updates

- byAdmin

- 15 May, 2024

- 20 Mins

Introduction

April 2024 has been nothing short of a rollercoaster for Bitcoin – and no, we’re not talking about the carnival ride at your local fair. From dramatic drops that made even the most stoic of HODLers raise an eyebrow, to network activity peaks that would make a roller skate derby proud, Bitcoin has had a month to remember. To top it off, Bitcoin ETFs had their share of adventures, and let’s not forget the rising wave of digital art and NFT action.

BTC Price Performance And Halving Charts

So, about that Bitcoin price. April started on a high note, boasting a solid $72,500 on April 8. By April 20, we saw the supposed harbinger of doom – the fourth halving – and with it, a price fall that took Bitcoin below the $60,000 mark faster than you can say "Satoshi." The worst was around April 30 to May 1 when Bitcoin hit $57,000, the lowest since late February. If you’re a fan of historical parallels, you’d be fascinated to note this drop mirrored the behavior seen in previous halving events. According to the big brains at Glassnode, historical halvings typically lead to short-term stagnations followed by minor dips – more like a winding road than a drop-off a cliff.

Interestingly, an analyst from 10x Research, Markus Thielen, put out a rather poetic tweet warning that Bitcoin might sink to $52,000. Apparently, ETF inflows, the main drivers of the previous rally, took a nosedive. And in a twist of analyst knife-fighting, Fidelity Digital Assets gave Bitcoin the "meh" treatment by downgrading its outlook to “neutral,” arguing the coin's no longer the undervalued gem it used to be. On a brighter note, Bitfinex analysts are keeping their chipper mode on, predicting a sideways trend with swings of $10,000 until the prices start hiking again. Cheers to that!

Bitcoin’s Network Activity and Fees

Daily Transactions

Let’s switch gears and talk about network activity, which spiked even as the price plunged. Daily transactions skyrocketed by 135%, hitting a record high of 927,000 on April 23 – guess everyone was busy proving Satoshi wrong. By the end of April, however, we saw the activity drop to 403,000 daily transactions. This intense yet fleeting action was largely fueled by the Runes protocol, effectively turning the Bitcoin network into the Las Vegas of blockchain transactions.

Active Addresses

Daily active addresses on the Bitcoin network had their dramatic moments too. Starting at 605,000 on April 1, they moved up to 640,000 by April 4. But right after the halving event on April 20, they nosedived to 269,000, only to recover partially to 483,000 by the end of the month. It’s like watching a high-stakes soap opera, with address traffic playing the lead role experiencing wild emotional swings!

Transaction Fees

Transaction fees on Bitcoin went utterly bonkers. We had daily fees peaking at a mind-bending $25.8 million on April 24, calming down to an average of $16.77 for the month. April 24 also saw the average individual transaction fee skyrocketing to $40 before settling down to a relatively modest $11.92 by the end of the month. Let’s just say anyone playing with Bitcoin at that time probably wasn’t thrilled about the surcharge.

Total Value Locked

If you think that’s impressive, wait till you hear about total value locked (TVL) in April. Bitcoin managed to attract more capital, hitting $1.4 billion in TVL, a colossal 94% increase from $724 million on April 2. That’s like finding out your old ’90s Pokémon cards are suddenly worth a fortune – almost literally.

Runes Protocol Impact

The Runes protocol emerged as the new sensation with Bitcoin users willing to spend crazy amounts to inscribe rare digital assets. The first block post-halving became the most expensive ever mined, with users shelling out a staggering 37.7 BTC (over $2.4 million). This protocol allows token creation using a more efficient model than the older BRC-20 standard, thereby making the Bitcoin network venue more excited than a midnight taco run.

Confirmed Payments

Bitcoin, partly due to Runes, saw its highest number of confirmed payments ever – 1.63 million on April 23. This surge came alongside Bitcoin reclaiming transaction dominion by the end of April, comprising some 82.6% of network activity. For that day, Runes transactions made up a mammoth 81.3%, leaving other existing protocols in the dust.

All these changes signify that while the price is subject to the whims of market madness, Bitcoin’s underlying activity and innovations are aggressively bustling ahead. So, whether you’re a trader, investor, or just a crypto-enthusiast, be sure to watch out for what the Bitcoin landscape brings next. It’s practically a thriller novel at this point!

Spot Bitcoin ETFs

Alright, folks, brace yourselves because April has been the roller coaster of all Bitcoin roller coasters. It’s like Bitcoin decided to pull a disappearing act right in front of our eyes, and the ETFs are still grappling to find their equilibrium. Intrigued? Let’s dive in!

US and Hong Kong Spot Bitcoin ETFs

April was a tough month for Spot Bitcoin ETFs, especially in the US. After experiencing staggering inflows earlier in the year, we saw a $343.5 million net outflow—an ETF exodus if you will. Over on the other side of the Pacific, Hong Kong entered the fray with its first three Spot Bitcoin ETFs. Despite the novelty, the Asian market’s fresh inflows couldn’t cover the stateside losses. Looks like Bitcoin’s playing a global game of “Will they, won’t they?” with us.

DTCC Collateral Decision

The Depository Trust and Clearing Corporation (DTCC) decided to throw a wrench into the ETF party by ruling out cryptocurrencies as collateral for loans and credit facilities. This ruling could make Bitcoin ETFs less appealing for some institutional investors. However, fear not! It only applies to inter-entity settlement within the line of credit, meaning the lending and brokerage activities continue unaffected as long as your broker doesn't mind risking a bit.

Morgan Stanley and UBS Plans

You know a party’s legit when heavy hitters show up. Rumor has it Morgan Stanley and UBS are planning to offer Spot Bitcoin ETFs. These guys collectively manage trillions (yes, trillions with a 'T') in assets, which signals Bitcoin's shift towards mainstream legitimacy. So, get ready for these traditional finance giants crashing the crypto party and potentially driving broader investor interest.

Australia's Bitcoin ETFs

Down under, Australia hasn't been left out of the Bitcoin ETF bonanza. The Australian Securities Exchange (ASX) is expected to list its first Spot Bitcoin ETFs by the end of 2024. Several big-name players, including VanEck and local firms like BetaShares, have already filed applications. With a market cap of $2.7 trillion, the ASX is a significant player in the finance world. The addition of Bitcoin ETFs could offer a whole new basket of goodies for Aussie investors.

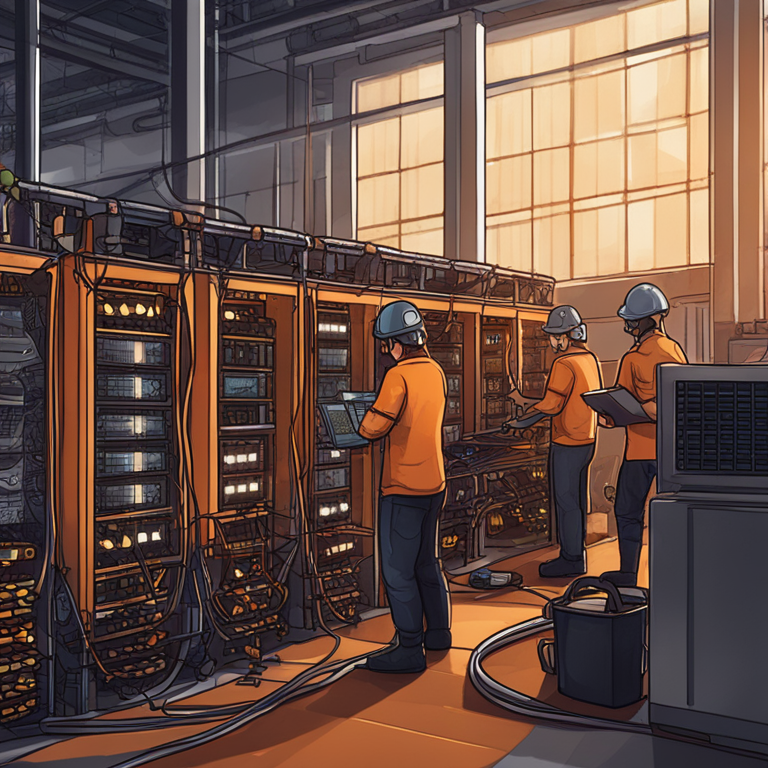

Bitcoin Mining Updates

Post-Halving Miner Earnings

The miners are feeling the squeeze! After the halving slashed Bitcoin rewards from 6.25 to 3.125 BTC, mining profitability took a nosedive. According to Hashrate Index, the hash price plummeted below $45 per PH/s per day. CryptoQuant data echoes this, showing a post-halving drop to $0.07 per hash price. Despite the doom and gloom, miners are hanging on. So, no mass miner capitulation...yet. But if Bitcoin prices keep tumbling, we might see some panic selling to stay afloat. Fingers crossed, folks!

New Mining Systems and Heat Utilization

Innovation in mining is sizzling, literally. Payments company Block (formerly Square) is developing a new Bitcoin mining system with a snazzy 3-nanometer ASIC chip. Finland’s taking it a step further, integrating waste heat from Bitcoin mining into its district heating system. Talk about killing two birds with one incredibly hot stone. This could be a sustainable way to heat Finnish homes during their harsh winters. Efficiency at its finest!

Regulatory Developments

Norway decided to crank up the regulatory dial, requiring all data centers to register and disclose operational details. This aims to boost transparency, particularly in Bitcoin mining activities. Energy Minister Terje Aasland hopes this will help local authorities make better decisions regarding data center operations. It’s a move that could impact Bitcoin miners, making it essential to keep an eye on how other countries might follow suit.

Bitcoin DeFi Updates

Runes Protocol

Ordinals have breathed new life into the Bitcoin DApp ecosystem. Enter the Runes protocol—a new token creation standard on the Bitcoin blockchain. Runes are making waves by allowing users to tokenize real-world assets directly on the Bitcoin network. This could push more activity to Layer 2 solutions and spark increased adoption of Bitcoin-native DApps. So, keep your runes close, adventurers!

Stacks Layer 2 Network

The Stacks network reached new heights in April with an all-time high of 122,497 active accounts. This Layer 2 network is making a name for itself, with more users engaging in transactions and smart contract functionalities. It’s clear that innovation and activity are alive and kicking on the Stacks network, promising exciting developments in the world of Bitcoin DeFi. The blockchain party just got a whole lot more crowded and lively!

Orders DEX Roadmap

The Bitcoin decentralized exchange scene is popping off, and Orders Exchange is leading the charge. Their 2024 roadmap includes plans for integrating major Web3 wallets and creating a Bitcoin NFT marketplace. They’ve already integrated with the Runes protocol, allowing for fungible token issuance, and built a bridge with sidechain MicroVisionChain for BRC-20 token swaps. Buckle up, folks, because Orders DEX is setting the stage for some major Bitcoin DeFi action!

BEVM Scaling Solution

Launched in March 2024, BEVM—a new scaling solution built on Taproot consensus—quickly gained traction. Over 700,000 user addresses and 30+ ecosystem projects joined the BEVM fray in April. This Layer 2 solution uses BTC for gas fees and features a valuation of $200 million. With an additional investment from Bitmain, BEVM is positioning itself as a significant player in the Bitcoin DeFi landscape. Exciting times ahead!

Bitcoin Ordinals NFTs

Market Valuation and Activity

Hold onto your digital hats, folks, because the Bitcoin Ordinals market isn't just making waves; it's creating tsunamis! With a jaw-dropping valuation of $2.3 billion, even in a broader market downturn, it's safe to say Bitcoin Ordinals are having their moment in the decentralized spotlight. These bad boys live solely on the Bitcoin blockchain, unlike most popular NFTs that prefer to flirt with centralized servers. This makes them not only less vulnerable but also the cool kids on the block.

According to Dune Analytics, the network has surpassed 66.3 million inscriptions, generating over $267 million in transaction fees. That's a lot of digital scribbling! Asset manager Franklin Templeton agrees, calling Bitcoin Ordinals the Picasso of the current digital renaissance. Meanwhile, OKX Ventures highlighted in their 2024 Bitcoin Outlook report that Bitcoin Ordinals will be the Beyoncé of the blockchain world this year.

Of course, there's a downside. The massive increase in transaction volume has congested the Bitcoin network faster than you can say "digital cat art," leading to higher fees and slower processing times. Binance even threw in the towel on April 4, discontinuing support for Bitcoin Ordinals to avoid further network strain. Talk about digital drama!

NFT Sales and Leading Collections

If you thought the market news was spicy, wait until you hear about the sales! April alone saw Bitcoin NFTs topping the charts with a staggering $594 million in sales, outshining 23 other blockchain networks. We're talking about a 93% increase from February, with around 113k eager buyers and 98k enthusiastic sellers trading more than 340k NFTs. That’s some serious digital chemistry.

Uncategorized Ordinals, the kind of NFTs that march to the beat of their own drums, led the sales volume, hitting $316.9 million across 219k transactions. Not too shabby, huh? Trailing them is the NodeMonkes collection, scooping a cool $32.7 million in sales. Then there's the Runestone ($RUNE) collection, which saw a meteoric rise with $798.4k in April sales—a mind-boggling 10836% increase from March. Now that's what I call a growth spurt!

We also have $PUPs, an NFT collection utilizing the BRC-20 protocol, which reached a trading volume of $72.7 million, marking a 2087% jump from last month. Clearly, these digital assets are fetching some serious online attention and, let’s not forget, dollars!

Notable NFT Launches

April was bursting at the seams with exciting new NFT launches. First up, we had Ordinal SigmaX, a digital collectibles project featuring 5,555 unique and fully animated pixel-art profile pictures (PFPs). This collection spent a week mesmerizing collectors from April 2 to April 9. Next on the hit list, from April 12 to April 19, was The Rune Guardians—10,000 PFP NFTs that laid claim to the Bitcoin blockchain. Fancy an airdrop? This project sure did, distributing "Rune" NFTs to members of over 20 Ordinals communities.

To round off the month, we had Rune Mining Pups (April 20 to April 27), a collection of 10,000 unique 2D pixel art NFTs. These aren't just pretty pictures either. This collection comes with DAO functionalities and benefits for the holders, revolving around characters who strike it rich in the digital landscape. Clearly, the NFT landscape is brimming with creativity and potential. Let's just hope these digital doodads stay valuable and don't end up in the digital discount bin!

Looking ahead – Can the Bitcoin Halving Charts be Inversed?

Institutional Investment

The big guns are loaded, and institutional investment is aiming right at Bitcoin. Here’s the deal: when stalwarts like Morgan Stanley and UBS decide to offer spot Bitcoin ETFs on their platforms, you know there’s serious momentum. Think of it as Bitcoin getting its first tux for the institutional prom. While the DTCC’s decision to exclude Bitcoin as collateral might dampen some spirits, it won't rain on Bitcoin's parade. Remember, big fish bring in their own school, and we might see even broader investor interest swirling around.

Future foresight also seems favorable. Major financial institutions taking the plunge could mean mainstream acknowledgment of Bitcoin's legitimacy. This isn't just a crypto moon-shot but a potential paradigm shift in how we view and invest in digital currencies. Security, value, and long-term growth? That's the trifecta driving institutional bulwarks into Bitcoin’s deep waters. And when the whales swim, minnows follow; the influx of institutional interest is bound to have ripple effects across the entire crypto pond.

Regulation

Regulation—often the slipperiest of points—is inevitably part of Bitcoin’s trajectory. Norway is leading the charge with new legislation requiring data centers to register formally, which could impact Bitcoin mining operations. Terje Aasland, Norway’s Minister of Energy, clearly doesn't want any miners lurking in the shadows. Increased transparency allows local authorities to make informed decisions about how these centers—and their crypto-hungry machines—fit into the broader community fabric.

How other nations approach regulation will be make or break for Bitcoin’s adoption. The regulatory landscape can either clear the path for broader acceptance or serve as a tangled web that stymies growth. Will other countries follow Norway’s lead, or will they blaze their own trails? As we navigate these regulatory waters, one thing is clear: Bitcoin’s journey to the mainstream will be anything but dull.

Bitcoin DeFi

DeFi on Bitcoin—sounds like a match made in digital heaven, doesn't it? The April 20 launch of the Runes protocol shows us just how much potential there is for decentralized application ecosystems on the Bitcoin network. Runes may sound like they belong in a fantasy novel, but they’re the real deal when it comes to representing real-world assets (think real estate, stocks, commodities, and even other cryptocurrencies) using tokens on Bitcoin.

And Runes isn’t hogging the spotlight solo. Stacks, a Layer 2 network, reached a new all-time high of 122,497 active accounts in April, highlighting a surge in Bitcoin-native DApps. Orders Exchange rolled out its 2024 roadmap, planning integrations with major Web3 wallets and a Bitcoin NFT marketplace. Plus, BEVM, a Layer 2 scaling solution launched in March, drew over 700,000 user addresses in no time—talk about making a grand entrance!

If these developments keep gaining traction, we could see a significant boost in Layer 2 solutions and broader adoption of Bitcoin-native DApps. The once-barren landscape of Bitcoin DeFi now looks like a bustling city, teeming with innovative projects and enthusiastic participants. Will it rival Ethereum or Binance Smart Chain in the DeFi space? Only time will tell. But if there's one thing we can bet on, it's that the DeFi revolution on Bitcoin is just getting started.

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.