Introduction

Who doesn't love a thrilling tug-of-war? It’s like an epic face-off that leaves the audience on the edge of their seats. Well, if you happen to be a meme coin enthusiast, then grab your popcorn because Dogwifhat (WIF) is staging one heck of a showdown. Since hitting a peak of $0.49 back in March, WIF has been hovering within a tight price range. Just like a boxer stuck in a clinch, neither buyers nor sellers seem ready to deliver the knockout punch. So, what’s really brewing in Dogwifhat’s universe? Let’s jump into the ring and find out!

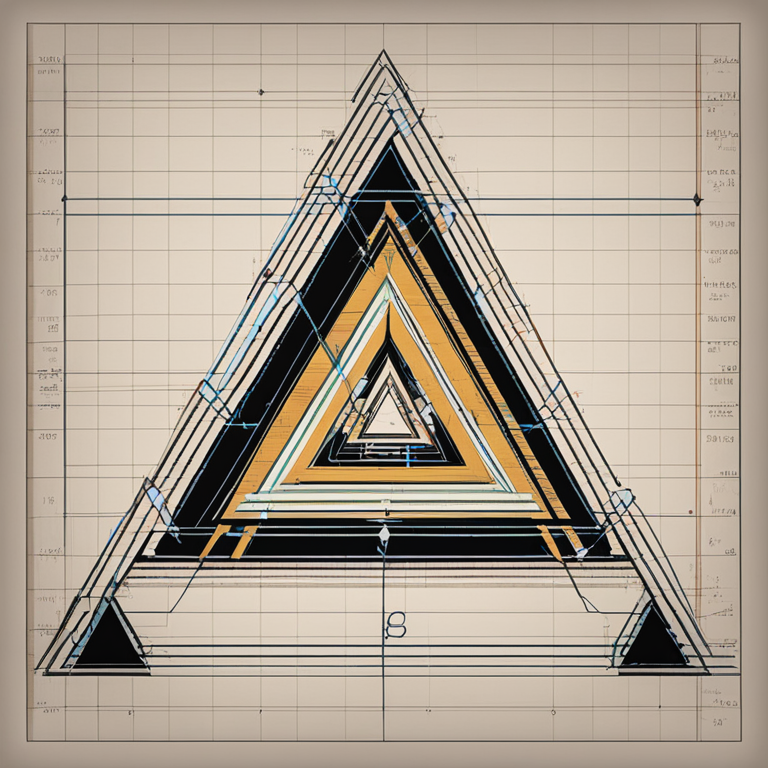

Formation of Symmetrical Triangle

Picture a dance floor where two equally skilled partners mirror each other's moves. That’s essentially what happens when a symmetrical triangle forms in the trading world. For Dogwifhat (WIF), it’s been about climbing to those higher highs and dipping to lower lows—keeping both bulls and bears on their toes. This dance indicates neither side has the upper hand in moving the meme coin's price significantly, leading to a period of consolidation. We’re talking about one price ceiling, one price floor, and a lot of head-scratching about where this ship is going to sail.

But wait, there are some cues we can take from the ballroom. A notable bullish signal for WIF is its rising futures open interest. At the last count, it stood at $304 million—a 23% increase since the beginning of May. When we see open interest climbing, it means more market participants are entering new positions, suggesting heightened interest and potential for significant moves.

Yet, it’s not all sunshine and rainbows. Despite this uptick, WIF’s funding rate across cryptocurrency exchanges has stayed positive, which isn’t too shabby. A positive funding rate means the contract price of WIF is higher than its spot price—basically, more traders are holding onto long positions. As of now, the funding rate sits at $0.004%. Not exactly enough to break out the bubbly, but it’s a positive sign nonetheless.

Bulls and Bears Tussle

Dogwifhat (WIF) has found itself in quite the pickle lately, caught in a tight range since it reached its year-to-date peak of $0.49 on March 31. You could say it's been playing a high-stakes game of tug-of-war with itself, forming a symmetrical triangle that's got everyone scratching their heads. Will it break out, or will it crumble under the pressure? That’s the million-dollar question—or the 49-cent question, to be more precise.

When a symmetrical triangle forms, it's like watching someone try to balance a scale that's a bit stubborn. The price hits a series of lower highs and higher lows, leaving both buyers and sellers in a stalemate. They try, they push, they pull, but nobody seems strong enough to make a clear trend. It's like watching a cat chase its tail—entertaining yet confusing. During this balancing act, you'll see flashes of bullish and bearish signals, making it seem like anything could happen next.

Rising Futures Open Interest

In the middle of this back-and-forth drama, WIF has a bullish ace up its sleeve: rising futures open interest. At the time of writing this article, open interest stands at a whopping $304 million, marking a 23% increase since the start of May. That’s like adding extra fuel to an already stoked fire, but in the market's context, it means more people are diving in, taking new positions in WIF futures contracts.

Futures open interest is kind of like the headcount in a very selective club. The more it grows, the more action is happening behind the velvet ropes. This uptick indicates that market participants are actively entering new positions, possibly gearing up for a big move. It's somewhat like preparing for a grand twist in your favorite TV drama—you know something significant is about to happen, but you’re not sure what.

Funding Rate Trends

Despite WIF's price doing the cha-cha in a narrow range, its funding rate across multiple cryptocurrency exchanges remains positive. Funding rates in perpetual futures contracts are the mechanisms that keep things fair, ensuring the contracted price doesn’t drift too far from the spot price. A positive funding rate is an indication that more folks have their money on WIF heading upwards, as the contract price is a tad higher than the spot price.

At press time, WIF's funding rate is sitting pretty at $0.004%. So, even though the price isn’t exactly setting off fireworks, the underlying sentiment is upbeat—or at least cautiously optimistic. Think of it as a poker game where the players are holding their cards close to their chests but you notice a few sly grins—something’s brewing behind those poker faces.

Mixed Signals for Dogwifhat

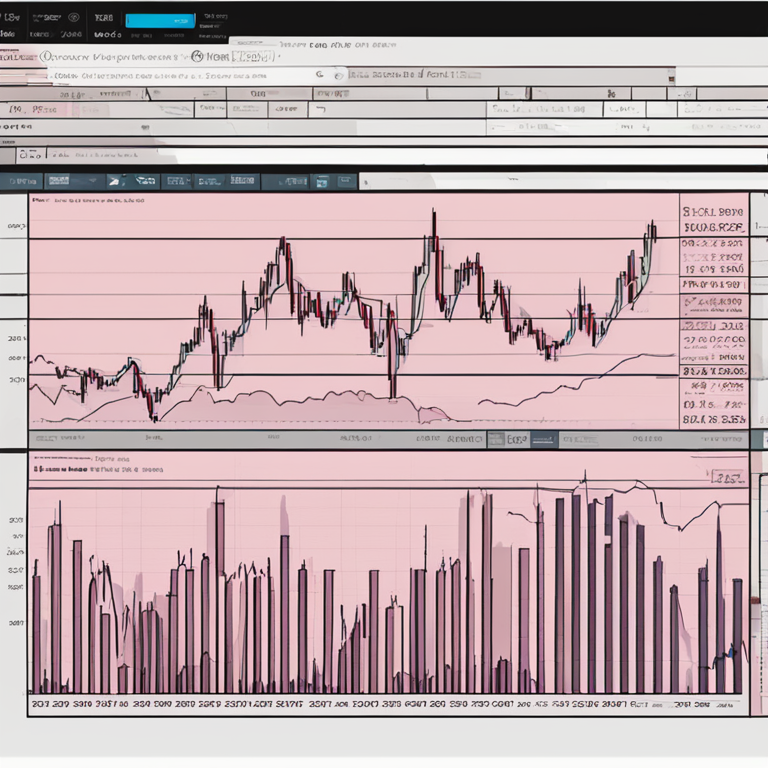

While the funding rates and futures open interest make it seem like WIF is gearing up for a bullish breakout, the technical indicators are less enthusiastic. It's like getting a pep talk from one friend while another is busy pointing out all the potential pitfalls. One such party-pooping indicator is the Moving Average Convergence Divergence (MACD).

MACD Analysis

WIF's MACD has been throwing shade on the bullish hopes. As of the moment, the MACD line is lounging below the signal line, a clear giveaway that selling activity is outpacing buying. That’s what traders call a bearish signal. Essentially, it’s signaling to traders that now might be the time to sell rather than buy. Imagine if your stockbroker sent you a sad emoji with your portfolio update—yes, it's that kind of signal.

What this means in plain English is that the short-term moving average is below the long-term moving average, a sign that things might get worse before they get better. WIF’s MACD positioning suggests that despite some bullish sparks, the overall sentiment is leaning towards the bears. Maybe it’s time to get those emergency parachutes ready, just in case.

Parabolic SAR Indicator

The Parabolic SAR (Stop and Reverse) indicator is another gloomy weather vane pointing towards tougher times ahead for WIF. This little helper identifies trend directions and potential reversals. Right now, the dots of the Parabolic SAR are sprinkled over WIF’s current price. When this happens, it's not a good sign, indicating the market might be heading south for a while.

Basically, these dots serve as tiny road signs warning that the price might continue to drop. Visualize it as breadcrumbs Hansel and Gretel left behind, showing you the way back—or in this case, down. At press time, all signs point to a rather pessimistic outlook unless some bullish force comes in like a knight in shining armor to flip the script.

WIF Price Prediction

Hello fellow crypto enthusiasts! Let’s dive into the wild universe of Dogwifhat (WIF), the meme coin that’s been making waves by staying put. I know that sounds a bit paradoxical, but hang on because we are about to explore why this coin sitting tight inside a narrow range is making such a splash.

So, picture an asset like WIF caught in a tight hug from both sides, creating a symmetrical triangle. It’s like watching a wrestling match where both sides are equally matched. On one hand, we have the bullish signals cheering, backed by a 23% growth in futures open interest since the start of May. On the other, we have bearish signals waving their red flags as WIF's MACD chart looks glum, signaling more selling. Let's break it down into two scenarios: what happens if the bears win, and what could unfold if the bulls take the crown. Spoiler: it's a nail-biter!

Bearish Scenario

Alright, let’s start with the gloomy side of the spectrum (cue dramatic music). At the moment, Dogwifhat is trading precariously close to the lower trend line of its symmetrical triangle at $2.97. If the bearish momentum gains strength and the bears manage to push WIF below this line, we might see the value tank down to around $2.5. It’s kind of like watching a soap opera where the hero is inching dangerously close to the cliff’s edge. The negative funding rates and bearish MACD can often be the wind that nudges them over. And don’t forget the Parabolic SAR – those little dots above our hero’s head – which are shouting "Look out below!"

A steep fall below $2.5 could spell trouble and might scare off some of our enthusiastic meme coin collectors. It’s essential to keep an eye on these indicators if you’re holding some WIF. Remember, in the crypto world, it’s not just about having diamond hands, but also smart hands. This bearish scenario hints that caution might be the better part of valor.

Bullish Scenario

Now, let’s switch gears to the sunny side (cue uplifting music)! Imagine the bulls assembling their forces, ready to charge. If the buying pressure ramps up and successfully pushes Dogwifhat’s price above $3, we could be in for an exciting rally. When bulls push, they push hard. The price could leap to $3.4 faster than my neighbor’s cat can spot a laser pointer.

Remember the rising futures open interest we mentioned earlier? It indicates more market participants are entering the fray with fresh positions, often a good sign for an uptrend. And those positive funding rates mean traders are still holding long positions, showing faith that WIF will play the hero in this story. The springboard could be these bullish signs, ready to launch WIF out of the tight symmetrical triangle towards new highs. So, if you’re a bull, keep your fingers crossed and your eyes on the prize!

Conclusion

In the end, whether you’re team bull or team bear, it’s crucial to keep an eye on these trends and indicators. Dogwifhat (WIF) is perched at a pivotal point, and both scenarios present some exciting, albeit nerve-wracking, possibilities. Will the bears drag it down below $2.5, or will the bulls lift it triumphantly to the $3.4 mark? It’s like waiting to see if your favorite show gets renewed for another season.

Keep those charts handy and your strategy nimble! And remember, in the roller coaster world of crypto, today’s bear could be tomorrow’s bull. This has been your friendly neighborhood guide through the tangled jungle of Dogwifhat’s market movements. Until next time, happy trading!

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.