Bitcoin Miner Bitfarms Enhances Paraguay Facility With New 100 MW Hydropower Deal

- byAdmin

- 14 May, 2024

- 20 Mins

Introduction

Bitcoin mining has been a hot topic for quite some time now, and when it comes to fulfilling our power-hungry crypto cravings, efficiency is essential. Enter Bitfarms, a significant player in the cryptocurrency mining industry. This powerhouse is making waves with its robust expansion strategy. Just recently, they announced securing an additional 100 megawatts (MW) of power from Paraguay's state-owned utility firm, ANDE. With this new deal, they intend to turn up the voltage on their operations at the hydro-powered Yguazu site, promising big things on the horizon. So, let’s dive into the nitty-gritty like a miner after a freshly minted Bitcoin!

Bitfarms secures additional hydropower

Deal Details

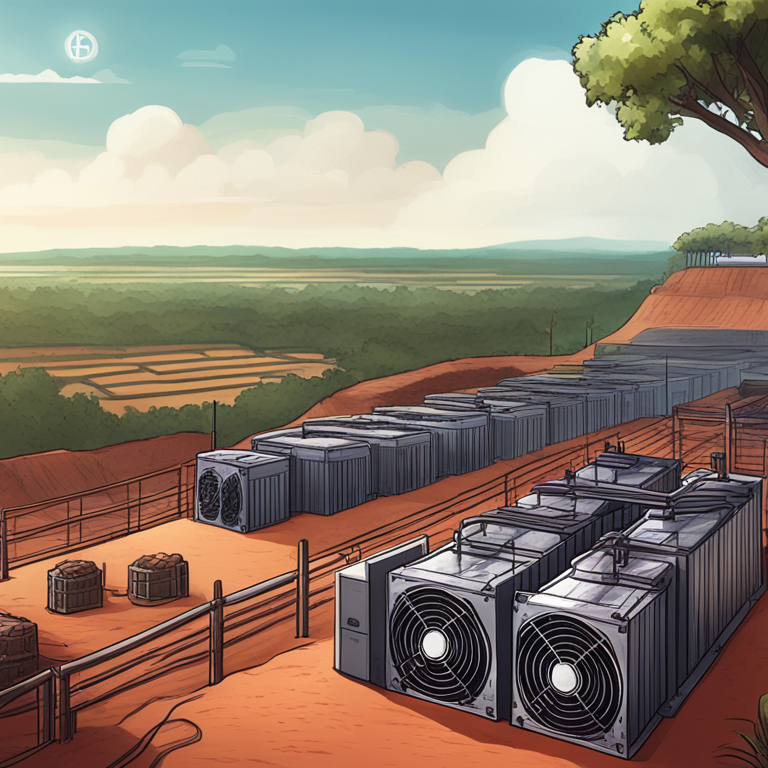

On Tuesday, Bitcoin mining company Bitfarms, which is listed on the Nasdaq and Toronto Stock Exchange (TSX), dropped a bombshell by announcing that they’ve secured an extra 100 MW from Paraguay’s ANDE. This deal is set to be a game-changer for Bitfarms, effectively doubling the capacity of their hydro-powered Yguazu facility. The new capacity is expected to be fully operational by 2025, which gives plenty of time to get your hype hats on. This expansion not only showcases Bitfarms’ ambitious growth plans but also sets a precedent for how cryptocurrency mining operations can balance sustainability with scalability. And let's face it, telling your friends you support hydro-powered Bitcoin might just earn you a few eco-friendly points at the next BBQ.

Power Source and Cost

The power fueling this crypto craze is coming from Paraguay's hydroelectric resources, which are known for being both abundant and cost-effective. Specifically, the deal provides hydropower that will churn out electricity at a bargain basement rate of $0.039 per kilowatt-hour (kWh). Not only is this insanely cheap—it also won’t be subjected to inflationary pressures, making it a win-win in the volatile world of crypto economics. Ben Gagnon, Bitfarms’ Chief Mining Officer, emphasized that this low-cost growth path supports their ongoing algorithmic ambitions without throwing a wrench into their current 21 EH/s (exahashes per second) target for 2024. Seems like Bitfarms is striking a balance between feeding its Bitcoin beast and keeping costs under control. It’s almost like finding buried treasure, but with spreadsheets.

Construction and Timeline

Construction at the Yguazu site kicked off in March and includes a high-voltage interconnection to the ANDE substation. Talk about bringing the juice! This isn't just about throwing up a few more servers; it’s a massive infrastructure project designed to optimize their mining operations. Damian Polla, Bitfarms’ General Manager for LATAM, pointed out that the megawatts were obtained directly through ANDE, without direct acquisition costs, adding an extra sparkle of financial frugality to the venture. The whole expansion aims to increase Bitfarms' overall megawatts under management by 23%, hiking up from 428 MW to an ambitious 528 MW. With this kind of robust infrastructure in place, Bitfarms is eyeing substantial growth in Paraguay, increasingly cementing its foothold in the region. And, despite a temporary dip in their stock prices (nothing a little positive PR can’t fix), BITF has already surged 37% over the past six months. So, stay tuned as Bitfarms continues to light up both the crypto world and the electrical grid!

Expansion plans

Hold onto your hard hats, folks! Bitfarms, the NASDAQ and Toronto Stock Exchange (TSX)-listed bitcoin mining company, has just cranked up the capacity dial at its hydro-powered Yguazu site in Paraguay. This juicy tidbit hit the news on Tuesday, and it's got the crypto community buzzing. The enterprise secured an additional 100 megawatts (MW) of hydropower from Paraguay’s state-owned energy firm, ANDE. So, what's the plan? This new wave of wattage is aimed at doubling the capacity of the Yguazu site, making it a crypto miner's paradise by 2025. Trust us, this isn't your average "let's add a few solar panels" kind of deal.

Chief mining officer's statement

Ben Gagnon, the man with the plan and the Chief Mining Officer at Bitfarms, couldn't contain his excitement on Tuesday. "The additional 100 MW provides a low-cost growth path for the first half of 2025 without impacting our 2024 21 EH/s target, which remains on schedule," he remarked. Now, unless you've been living under a rock, you know that EH/s stands for exahashes per second—a fancy term for saying how much Bitcoin they can mine. Gagnon is bullish (pardon the crypto pun) on the new expansion. Growing Yguazu to 200 MW is expected to rev up Bitfarms’ 2025 megawatts under management by 23%, from 428 MW to a whopping 528 MW. As Gagnon put it, this expansion isn't just a power grab; it's a strategic move to drive down overall costs per megawatt by leveraging their existing infrastructure. Essentially, they're making the most out of what's already built—like adding a guesthouse to your mansion.

Infrastructure and cost efficiency

The nitty-gritty of the infrastructure improvements began back in March, involving an impressive high-voltage interconnection to the ANDE substation. This isn't some rinky-dink extension cord; we're talking heavy-duty electrical engineering here. Imagine scaling up your home gym to an Olympic training facility but with fewer protein shakes and more kilowatts. With those 100 extra MWs, Bitfarms is poised to keep the electricity costs at a consistent $0.039 per kilowatt-hour (kWh), avoiding the pesky issue of inflationary increases. Gagnon emphasizes that their approach of amortizing development costs over a broad infrastructure base is akin to spreading cream cheese on a bagel—just enough to cover it all without breaking the bank.

Significance of Paraguay

Direct acquisition

Damian Polla, Bitfarms’ General Manager of LATAM (that’s Latin America for the uninitiated), gave us the lowdown on how they snagged those precious megawatts. "The megawatts were obtained directly through ANDE without any direct acquisition costs," Polla explained. That's right, they didn't have to trade in a single Bitcoin for this power surge. Going direct with Paraguay’s state-owned utility means eliminating middlemen and expensive fees, making it a financial no-brainer.

Growth opportunity

Now, why Paraguay, you ask? According to Polla, Paraguay represents Bitfarms’ most significant growth opportunity. With a jaw-dropping 270 MW of infrastructure expansion on the horizon, which includes both the new Paso Pe and the expanded Yguazu farms, the sky (or should we say the electrical grid?) is the limit. While Bitfarms' stock might be feeling the heat right now—having dipped 16.7% over the past five days—there’s still room for optimism. Over the past six months, BITF shares have climbed an impressive 37%. In short, it seems like Bitfarms is betting on a bright, electrically efficient future in the heart of South America.

Stock performance

Alright, let's dive into the exciting world of Bitfarms and how it's been performing lately. You know how they say, "one moment you're up, the next you're down"? Well, Bitfarms' stock has been on a rollercoaster. Over the past five days, their stock saw a decline of a whopping 16.7%. Ouch, right? Don't fret; the long-term looks a bit more cheerful as we'll discuss in the upcoming sections. But for now, let's just say that the market is as volatile as your favorite spicy meme coin.

Recent trends

Now, let's talk recent trends. Picture this - Bitfarms recently announced a massive power boost for their Paraguay operation. We're talking an additional 100 megawatts of hydropower! It's like winning the crypto mining lottery. This hydropower comes from Paraguay's state-owned utility firm, ANDE, and is expected to double the facility's capacity by 2025. So why the stock dip, you ask? Sometimes, the market is like a toddler with mood swings, reacting to the now rather than the long-term gains. The 16.7% drop over the past week may reflect short-term investor jitters rather than any real fundamental problem. So, while the present chart looks like a Tom and Jerry chase, the future trends are worth watching closely.

Long-term performance

Alright, fasten your seatbelts for a look into the future. Despite recent hiccups, Bitfarms' long-term performance has some sparkling highlights. Over the past six months, the company's stock has risen by 37%. Yep, you heard it right. This isn’t your average lukewarm stock. The planned hydropower expansion, which is expected to raise their 2025 target megawatts under management by 23%, is set to further buoy their performance. By 2025, they aim to push their capacity from the current 428 MW to 528 MW. Such strategic maneuvers suggest that Bitfarms is playing the long game, planning to solidify its position in the ever-evolving crypto mining ecosystem. With Paraguay being highlighted as their most significant growth opportunity, the long-term prospects are quite promising if you ask me.

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.