Bitcoin: Riding the Rollercoaster of Profit Peaks and Predicted Volatility

- byAdmin

- 07 May, 2024

- 20 Mins

# Bitcoin Teeters on the Edge: Navigating the Waters of Impending Volatility

In a riveting twist of fate, Bitcoin finds itself perched precariously at a tipping point, according to insights from CryptoQuant, forecasting a seismic shift in the cryptocurrency realm. With profitability soaring to dizzying heights, the specter of heightened market volatility looms large, promising both opportunities and challenges. This peek into Bitcoin's crystal ball unveils a landscape rife with potential sell-offs as investors scramble to cash in on their gains. Delve into the heart of the matter as we explore the intricate dance of market dynamics, investor sentiment, and the ever-present global economic backdrop shaping the future of this digital titan.

# Bitcoin Teeters on the Edge: Navigating the Waters of Impending Volatility

In a riveting twist of fate, Bitcoin finds itself perched precariously at a tipping point, according to insights from CryptoQuant, forecasting a seismic shift in the cryptocurrency realm. With profitability soaring to dizzying heights, the specter of heightened market volatility looms large, promising both opportunities and challenges. This peek into Bitcoin's crystal ball unveils a landscape rife with potential sell-offs as investors scramble to cash in on their gains. Delve into the heart of the matter as we explore the intricate dance of market dynamics, investor sentiment, and the ever-present global economic backdrop shaping the future of this digital titan.Bitcoin: Riding the Rollercoaster of Profit Peaks and Predicted Volatility

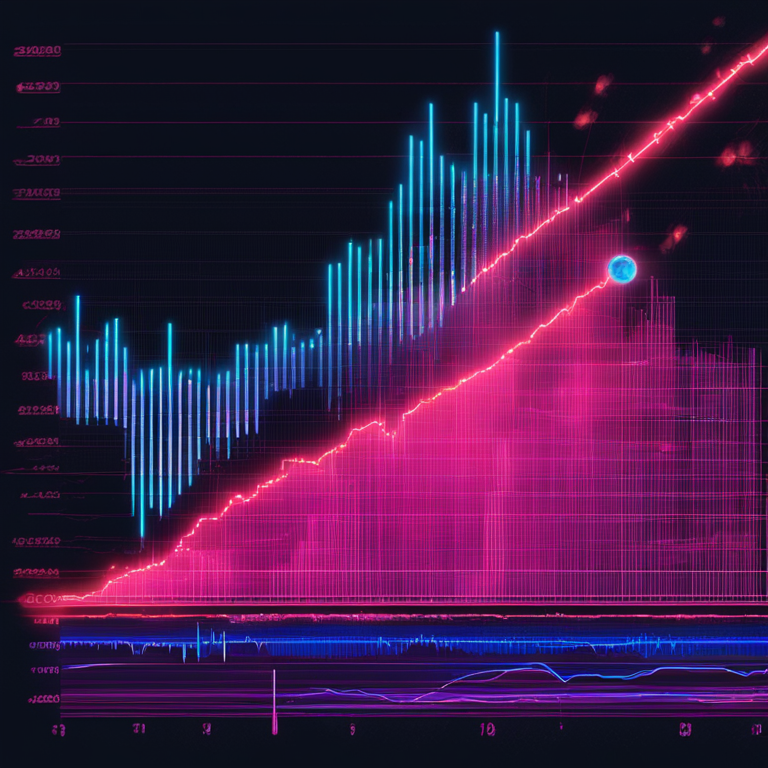

In the ever-twisting saga of the cryptocurrency world, Bitcoin has once again grabbed headlines, teetering on the brink of an exciting yet nerve-wracking precipice. According to the recent analysis from CryptoQuant, the Bitcoin market is showing signs of significant volatility on the horizon. A whopping chunk of Bitcoin holders are sitting pretty in profit-land, hinting at a potential rush to cash out and enjoy their gains. This scenario is historically a precursor to market mayhem, with increased sell-offs potentially leading to price swings that could make even the bravest investors' knees wobble. The core of CryptoQuant's warning revolves around the 'blue line' indicator, a critical gauge of the percentage of Bitcoin supply in the profit zone, which currently reads like a signpost towards volatility town.

Experts weigh in on this delicate dance of digits with a mix of cautious intrigue and seasoned wisdom. "When the blue line hits these levels, it's like watching storm clouds gather on a hot summer day," explains a CryptoQuant analyst, painting a vivid picture of the market's mood. Some see this as an opportunity layered with risks, suggesting that savvy investors could still ride the wave to their advantage, provided they keep their wits about them. These insights aren't just crystal-ball gazing; they're grounded in a thorough analysis of market trends, investor behaviors, and the intricate ballet of supply and demand that defines the crypto ecosystem.

The backdrop to this financial high drama is a global economy that's as predictable as a coin toss. Expansionary monetary policies worldwide, not traditionally friends to risk assets like cryptocurrencies, add another layer of complexity to the puzzle. This macroeconomic milieu, combined with the CryptoQuant's findings, paints a picture of a market at a crossroads, facing down a storm with equal parts potential peril and opportunity. Historically, Bitcoin has been no stranger to such crossroads, having weathered numerous storms to emerge, time and again, with its value and appeal to investors intact, if not strengthened.

Additional Nuggets of Insight

Digging deeper into the vault of cryptocurrency dynamics, let's sprinkle some hard numbers into our colorful conversation. Recent data has shown that a staggering percentage of Bitcoin is currently held in profit, a situation not seen since the dizzy heights of the last big boom. This might sound like party time for the Bitcoin bunch, but history has taught us that what goes up in the crypto world must brace for the potential slide down. The 'blue line'—that nifty indicator tracked by CryptoQuant—is not just a line; it's like the heartbeat of Bitcoin's market sentiment, pulsating with the potential energy of millions of dollars ready to move.

Further stirring the pot is the 'grey line,' a measure of market sentiment swinging between optimism and pessimism with the subtlety of a sledgehammer. Currently, we're dancing on this line like a tightrope walker without a net, signaling a market sentiment that could flip faster than a Bitcoin transaction. Combining these insights with the overall market conditions, especially the ever-looming shadow of expansionary monetary policies, gives traders and investors a roadmap that's as crucial as it is complex.

Wrapping It Up with a Bow

So, where does this rollercoaster ride leave us? Standing at the crossroads of potential and peril, the Bitcoin market is a spectacle that promises as much excitement as it does anxiety. The insights from CryptoQuant aren't just fancy number crunching; they're a clarion call to the savvy investor willing to navigate the tempestuous seas of cryptocurrency with a keen eye and a steady hand. The 'blue line' and 'grey line' serve as guiding stars in this financial cosmos, offering glimpses into the market's mood and the global economic winds that sway it.

As we peer into the future, armed with charts, graphs, and expert analyses, it's clear that Bitcoin's journey is far from over. Whether it soars to new heights or takes a dive into the depths remains to be seen, but one thing's for sure: it's going to be one heck of a ride. So, strap in, keep your eyes on the lines, and maybe, just maybe, we'll find our way through this labyrinth of numbers to the treasure that lies beyond. In the world of Bitcoin, volatility isn't just a word—it's a way of life.

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.