Arweave (AR) Eyeing $50 Mark: Breakout On The Cards, What’s Next?

- byAdmin

- 16 May, 2024

- 20 Mins

Arweave (AR) preparing for breakout

Alright, folks, pour yourself a cup of joe and get comfy because the crypto rollercoaster is gearing up again! This time, our star player is Arweave (AR), which seems to be eyeing the mighty $50 mark like a kid at a candy store. The token's price has been flirting tantalizingly close to this milestone, itching for a breakout. But what’s next, you ask? Let’s unravel the mystery.

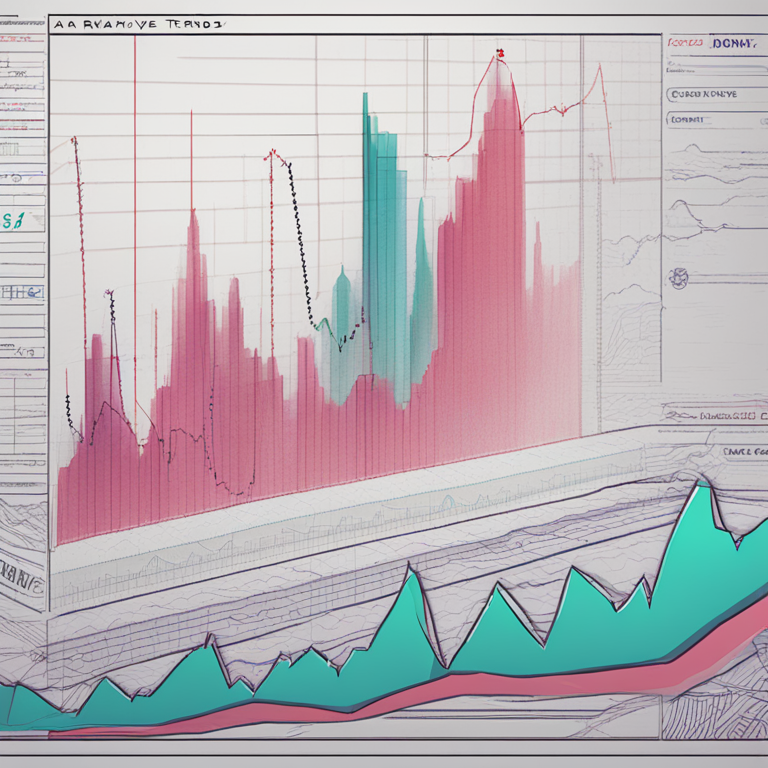

The daily charts are batting for the bull team, suggesting that a massive blast is on the horizon. And if you're a believer in technical patterns, here's a tidbit to tickle your fancy: a rounding bottom formation has made a guest appearance. This pattern might just be the magic wand summoning a swift upward movement. Picture an ambitious hiker doing an upward climb—yes, that's Arweave for you. It’s on an adventurous journey to its 52-week high of $45, but eyes are glued on the elusive $50 mark.

Just so you know, amidst the market's typical dramas—think ups and downs that could rival a soap opera—AR's movement has been reliably bullish. Investors are keeping a close watch, and the buying interest has been nothing short of encouraging. As the token trades beyond key Exponential Moving Averages (EMAs), it maintains high ground. Therefore, the token isn’t just talking the talk; it's definitely walking the walk.

Price action highlights

Bullish momentum reflection

Let’s dive into the nitty-gritty of AR’s bullish momentum. The charts are practically radiating positivity. At press time, the AR token was trading at $43.64, reflecting an intraday rise of 4.10%. Not too shabby, huh? This number isn’t just a benign little figure; it’s a reflection of the bullish sentiment energizing this token. Just consider the monthly return ratio of 70.20% and a mind-blowing yearly return ratio of 558.27%. Anybody up for some celebratory confetti?

In addition, the pair of AR and BTC sits comfortably at 0.000660 BTC, and the market cap happily balloons to $2.85 billion. Analysts aren’t holding back their enthusiasm either—they've slapped a 'strong buy' tag on AR, with predictions of a sharp breakout that could soon nudge it past the $50 barrier. So, tell your buddies, this token might be the next big headline-grabber!

52-week high trajectory

Picture this: Arweave (AR) is like a stickler for climbing mountains, setting its sights firmly on touching sky-high peaks. Zooming in on the 52-week trajectory, AR's persistently bullish stance makes it ready for a celebratory dance. Bull teams, dressed in optimism, are eyeing that emblematic $50 milestone as a breach point, ready to pop some virtual champagne.

Amidst this excitement, AR has crafted a higher-high setup pushing it close to its current 52-week high mark. This uptrend hasn’t gone unnoticed, gathering speculative buzz and consistent buying interest. Moreover, with an intraday trading volume that soared impressively by 67.67% to $222.90 million, the bullish sentiment couldn’t be more apparent. And with the Relative Strength Index (RSI) curve chilling in the overbought zone, it’s basically prepping for a breakout confetti shower!

Market metrics

Intraday rise and return ratios

It's quiz time, folks! What do you get when you mix bullish sentiment with investor enthusiasm? If you guessed a promising price trend, you’re right! The intraday rise for AR isn’t just a spike; it's a signal of robust market activity. As mentioned before, AR's intraday rise stood at 4.10%, contributing to a monthly return of 70.20% and a mind-boggling yearly return of 558.27%. These numbers are like sweet music to any investor's ears.

Furthermore, the pair of AR and BTC is budding at 0.000660 BTC, cementing its promising statistics. Analysts have been sidelining caution and rooting for an upward surge that might cross the $50 threshold, ushering in ripples of excitement. Whether you’re a seasoned trader or just a curious observer, these figures are well worth some attention.

Market cap and trading volume

Ah, numbers—the universal language of finance! Arweave's market cap is currently residing at a comfy $2.85 billion. That’s a large number in crypto, almost like the grand canyon in the middle of a desert. The most intriguing part is the trading volume, which recently hit a 67.67% rise, clocking in at a hefty $222.90 million. This significant spike isn't just a blip on the radar—nope, it’s a glaring signal of higher investor engagement.

If this surge in trading volume is any indicator, the AR token is performing like a rockstar on stage, basking in the spotlight and grabbing the limelight. The combined market metrics paint a vibrant picture, further bolstered by a steadily climbing Open Interest (OI) data showing a spike of 6.98% to $127.16 million in the last 24 hours. It’s an exciting time to be into AR, with a crowd that's not just watching but participating enthusiastically. And hey, with support levels at $40 and $36 and upside hurdles at $48, followed by $50, the stage is set for some captivating market fireworks!

Technical analysis

When it comes to the world of cryptocurrency, technical analysis is like trying to predict if that avocado on your counter will ripen or rot overnight—there’s a bit of magic, science, and pure guesswork involved. For Arweave (AR), the token has been showing some promising signs. The coin is currently trading at $43.64 with an impressive surge of 4.10% in a single day. If you’re holding AR, you probably have a grin as wide as a Cheshire cat's! The cryptocurrency has been on an uptrend, hinting at consistent investor faith and seemingly endless buying interest. What’s more? The token is surpassing its key exponential moving averages (EMA), looking mightier than ever. As for those yield ratios—let’s just say they’re as hot as the latest viral dance on TikTok, with a monthly return of 70.20% and a yearly bonanza of 558.27%. Analysts predict we might see a breakout soon, possibly shattering that glossy $50 ceiling. Buckle up, folks!

Rounding bottom formation

First up on our technical journey is the Rounding Bottom Formation, which sounds a lot like a Pilates move but is actually a bullish reversal pattern. If you squint hard enough at the AR daily chart, you’ll see a gentle, bowl-shaped curve climbing steadily upward. This formation is like the rising sun at dawn for AR speculators—a sign that the token might shoot up dramatically soon. Closing in on its 52-week high, the AR token is slowly coiling tighter than a spring, ready to burst past the $45 mark and eyeing that ambitious $50 target. The market has been full of ups and downs, but AR has remained steadfast, reflecting persistent investor optimism and increasing trading volume.

EMA trends

Now let’s chat about those EMA trends, shall we? Think of exponential moving averages as the GPS for AR's price movements, guiding traders through the murky waters of the crypto market. Currently, AR is not just beyond these key EMAs, it’s practically doing a victory lap. The token is performing a classic dance of higher highs and lower lows, reinforcing its upward momentum. So, if you’ve been biting your nails waiting for a downturn, you might want to start growing them out again. Investors seem to have thrown their weight behind the token, suggesting confidence in its long-term potential. The EMA trends are just the cherries on top confirming the bullish narrative for AR.

RSI overbought zone

Hold on to your hats as we delve into the RSI (Relative Strength Index) overbought zone. This magical metric helps traders determine if the asset is overbought or oversold—think of it as a mood ring for AR tokens. As of now, the RSI curve is lounging comfortably in the overbought territory like a sunbather on Miami Beach. It’s signaling that traders are in a buying frenzy, almost like shoppers during a Black Friday sale. This level of RSI often precedes a breakout, suggesting that AR is prepped for a massive price surge. So, whether you’re in it for the long haul or just riding the wave, keep a close eye on AR’s RSI; it’s got some stories to tell.

Investor sentiment

Volatility and speculations

Moving on to investor sentiment, it’s crucial to understand that the crypto market is like a rollercoaster built by a mad genius—wildly unpredictable. The volatility chart for AR resembles a lie detector test gone haywire, shooting upward and reflecting traders' excitement and anxiety. As AR’s price flirts with new highs, the volatility has ramped up, suggesting sellers may be getting jittery, possibly looking to close their positions. Amid this chaos, buyers seem undeterred, keeping up the momentum. Speculations are running festive, with market participants debating whether AR will hit that golden $50 mark.

Weighted sentiment data

Speaking of sentiment, let’s add some weight to it—literally. Weighted sentiment data for AR hovers blissfully above the midline at approximately 0.727. This isn't just any number; it’s a badge of positivity, a beacon of hope for bullish traders. High-weighted sentiment indicates that market participants have an optimistic outlook on AR’s future. It’s like the market’s mood swing indicator and for AR, the mood seems to be on cloud nine. With this kind of sentiment data, it wouldn’t be surprising to see AR breaking through the predicted resistance levels.

Futures and open interest data

Long buildup activity

Now, let’s dive into something called "Long Buildup Activity," which sounds like a strategy meeting for Wile E. Coyote but is, in fact, a significant trading tactic. Over the past few weeks, consistent buying interest in AR has led to an upward surge in open interest contracts. For a token nearing its breakout, this is like presenting a fresh batch of cookies to Santa Claus—a surefire way to win. Investors are piling up long positions, reinforcing the fact that they anticipate AR’s upward journey to continue.

Open interest surge

The open interest data showcases a spike greater than 6.98%, climbing to a robust $127.16 million in the past 24 hours. This uptick in open interest acts like a neon sign in Las Vegas, attracting trader’s attention and reinforcing their optimistic stance on AR. It’s the kind of data that makes you want to throw your hands in the air (with joy, of course). This surge highlights that market participants are gearing up for a long-term commitment and expect AR’s price to hit stellar heights. With such consistent activity, AR is setting the stage for a memorable performance.

Popularity metrics

Social media followers increase

Popularity may be fickle in high school, but in the crypto world, it’s a reliable indicator of a token’s potential. On social media platforms, AR’s followers have spiked dramatically, now standing at a robust 48k. This isn’t just a number; it’s an army of engaged enthusiasts who can’t stop talking about AR’s upward trajectory. The more followers, the louder the buzz and the higher the optimism for AR. It’s like a snowball effect: the more people follow, the more others want to join in, fueling a cycle of positive investor sentiment and heightened market activity.

Development activity data

Finally, development activity data for AR has also shot past the midline, underscoring continuous growth and project enhancements. This data gives traders that warm, fuzzy feeling—the reassurance that the team behind AR is working relentlessly on improvements and innovations. Increased development activity suggests not just a hot phase, but a sustainable future. It’s akin to knowing that the great and powerful Oz is indeed working the levers behind the curtain. For AR, such strong development signals are an encouraging backdrop to its bullish journey.

Support and resistance levels

Alright, let’s dive right into the nitty-gritty. In the fast-paced, caffeine-fueled world of cryptocurrency, key support and resistance levels often act like the bouncers at a swanky nightclub — either holding the line or letting the bulls (or bears) charge through. When it comes to Arweave (AR), the immediate support levels are pegged at $40 and $36. Think of these as the safety nets for any unexpected market slip-ups. If the market decides to do a little cha-cha and dip, these levels provide a cushion to prevent a nosedive.

On the flip side, the upside hurdles for Arweave are sitting pretty at $48 and $50. The $48 mark is the first gateway. Should the AR token manage to break through, it's like finding a hidden level in our favorite video game — full of potential and excitement. The grand objective for the bulls is, of course, the big 5-0. Cracking this would likely send confetti cannons off in the crypto trading world, symbolizing a robust breakout and signalling a potential rally.

So why all the fuss about these levels? Imagine support as your trusty pal who holds you steady when you’re tipsy, and resistance as that ceiling you keep jumping to hit (we all did it as kids, no shame). In trading terms, breaking through or bouncing off these levels can make a huge difference in a trader's strategy — a make-or-break moment if you will. Given Arweave's recent bullish performance and growing investor interest, both the $40 support and $50 resistance levels are key areas to watch closely.

Conclusion

In conclusion, Arweave (AR) has been showing off some impressive moves on the cryptocurrency dance floor. Not only has it climbed near its 52-week high, but it's also gearing up to possibly break the $50 mark. That’s like your favorite roller coaster reaching the highest peak before the exhilarating drop. Investors are clearly excited — the intraday rise of 4.10% is evidence of the market’s bullish pulse. Add in a monthly return ratio of 70.20% and a yearly return ratio of a jaw-dropping 558.27%, and it’s hard not to feel the FOMO creeping in.

The market's backing, combined with solid support and resistance levels, places Arweave in a prime position. Breaching the $50 mark could trigger further upward momentum, putting those metaphorical rocket emojis we love to use to good work. The sentiment data and Open Interest (OI) metrics also paint a positive picture, echoing the upward trend and investor interest. For now, all Arweave needs to do is keep the music playing and the bullish vibes flowing. If it can do that, the sky might just be the limit (or at least $50 for starters).

Disclaimer

Alright folks, time for the serious bit — the disclaimer! Remember, the views and opinions expressed in this jazzy little piece are for informational purposes only. They do not constitute financial, investment, or other advice. Cryptocurrencies are as volatile as my mood before morning coffee — one minute they soar, the next they might tumble. Always do your own research and consider consulting a financial advisor before making any investment decisions. Invest wisely and don’t let the allure of quick gains lead you astray.

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.