Introduction

Imagine if the slow and steady tortoise in the famous fable suddenly got a turbo boost and controls of a spaceship! That’s Bitcoin for you: conservative, cautious, but always striving for more robust and secure development. At the core of Bitcoin's enduring success lies this deliberate approach, ensuring that nothing short of thorough consideration and rigorous testing leads to changes in the protocol. Today, let's delve into understanding how these fundamental principles shape Bitcoin, especially in the face of proposals that aim to rock the boat a little too aggressively.

Bitcoin Development Philosophy

Conservatism in the Bitcoin ecosystem isn't about politics; it’s about being as wary and thoughtful as a cat perched on a narrow ledge. Satoshi Nakamoto, the enigmatic creator of Bitcoin, instilled this careful philosophy from the get-go. The early adopters and developers who followed have meticulously respected this mindset, treating the protocol like a priceless relic. They understand that hasty, poorly-considered changes could jeopardize the entire network—akin to switching out an airplane's wings mid-flight. This isn’t just a preference but an essential practice ensuring Bitcoin remains robust, decentralized, and secure.

Key Cryptographic Assumptions

Here’s a fun fact that may help you win a crypto-themed trivia night: Bitcoin’s cryptography is built on the “discrete log assumption.” This assumption posits that given two large prime numbers, it’s computationally infeasible to factor them efficiently. This whole cryptographic party crumbles if this assumption breaks down, like if someone suddenly invented a magic factorizing wizard. The houses of crypto—walls, roof, chimney and all—would come crashing down. Private keys wouldn't be private anymore; they’d be as exposed as a sunbather who forgot their swimsuit. This makes stringent, skeptical evaluations essential before welcoming new proposals.

Confidential Transactions and their Implications

Before you get excited—no, Confidential Transactions (CT) are not Bitcoin's way of making secret handshakes. CTs were brainchildren of Gregory Maxwell for Bitcoin, designed to obscure transaction amounts from public view. Cool, right? The catch: they also carry the risk of secret inflation and data bloat, which kind of turns that coolness into a liability. Implementing CTs without breaking Bitcoin’s core cryptographic assumptions proved tougher than chewing through titanium. Thus, Bitcoin avoided adopting them, staying true to its conservative ethos. Bitcoin’s version of “better safe than sorry,” if you will.

Rationale for Conservative Proposals

You might say the Bitcoin community has a bit of a Goldilocks syndrome: proposals can't be too hot or too cold—they must be just right. Take the checktemplateverify (CTV) proposal, for example. It's simpler than a toothbrush, doesn’t enable any exotic new functionalities, and makes things like pre-signed transactions safer by enforcing consensus. Now, contrast this with drivechains—a proposition many criticize (rightly, perhaps) for potentially giving miners too much power, like letting the fox guard the henhouse. Conservative Bitcoin developers always keep an eagle eye out for any such proposals which may tip the decentralized balance, ensuring that any adopted changes don’t inadvertently centralize control.

Skepticism towards recent proposals

Let’s face it, the Bitcoin community isn't exactly a fan club for change. This isn't surprising, given the currency's origins in the conservative and cautious configurations of Satoshi Nakamoto himself. Each proposal, whether it's for something groundbreaking or for minor tweaks, is met with heaps of skepticism. And it's not unfounded. The Bitcoin protocol has a lot at stake. For instance, take BIP 119, also known as CHECKTEMPLATEVERIFY (CTV). I've been banging the drum for this one for years. It's super conservative; it doesn’t enable anything that can't already be done with pre-signed transactions. The difference? CTV enforces changes by consensus, reducing trust in humans prone to mistakes or, heaven forbid, malicious actions.

The Bitcoin community has long been the epitome of the saying, "If it ain't broke, don't fix it." The skepticism and caution have acted like an immune system, warding off potentially harmful changes—like a blockchain hypochondriac. That's not to say this conservatism isn't warranted. Every proposal comes with its own Pandora’s box of unintended consequences. Take the example of drivechains. When they were introduced as a scaling solution, they were pitched without negative externalities. Guess what? Folks like me have been shouting from the rooftops that this is baloney. Drivechains could carry severe negative impacts on the Bitcoin network, inducing centralization pressures and creating economic incentives for miners to behave badly.

Concerns with drivechains

So, what’s got people all hot and bothered about drivechains? For starters, drivechains allow anyone—yes, even that sketchy guy from your local crypto meetup—to become a block producer. This can be a big deal because, in reality, it gives miners a monopoly-like power. They don't have to worry about competition and can forward-run transactions just like Ethereum. Imagine a world where miners, thanks to this monopoly, extract value from transactions, disrupting the utopia of decentralization and fairness we've grown so fond of.

But that’s not even the worst part. Drivechains are essentially wolves in sheep's clothing. They might sound like a brilliant idea, improving scalability and all. Still, they introduce centralization pressures that could transform Bitcoin from the democratic, decentralized network we trust to a miner's playground where a handful of players call the shots. That’s not the kind of future anyone in the community wants. Especially not when we’ve worked so hard to avoid trusted third parties and centralized control like the plague.

Centralization risks and MEV

The dreaded centralization risk tied to drivechains is lurking, but let’s get into the weeds a bit. The system demands both the ability to restrict future coin transactions via covenants and to ensure the seamless transfer of data from one transaction to another. Easy peasy, right? Wrong. That’s how open UTXOs are created—tokens poised for anyone, especially miners, to facilitate withdrawals—like giving them the keys to the kingdom. And there’s an even juicier scoop: Miners have the incentive to abuse this system for profit.

Enter MEV, or Maximal Extractable Value—a fancy term for what happens when miners decide to get greedy and extract as much value as possible from transactions. This isn’t some rare, theoretical risk. It’s happening in the Ethereum ecosystem, and everyone’s trying to avoid it coming to Bitcoin like it’s the next pandemic. Enabling these functionalities means opening the floodgates to centralization, giving miners a buffet of opportunities to front-run transactions and essentially turn Bitcoin into their playground. It’s like giving wolves access to the chicken coop, then wondering why there’s a feather shortage.

Requirements for safe evolution

Let’s talk safety nets for a bit. Evolution is inevitable, but it needs guardrails. A proposal can’t just waltz in and change everything willy-nilly; it has to be vetted, tested, and cautiously integrated. Think of it as adding a new ingredient to your secret chili recipe—you don’t dump the whole jar in; you add a pinch, taste, and then proceed cautiously. This cautious approach is precisely what has kept Bitcoin stable all these years.

For a proposal to even get a foot in the door, it needs to be fundamentally sound and well-researched. Drivechains set off alarm bells because they breach this principle; they’re like that overconfident new chef who wants to overhaul the menu without understanding the regulars' preferences. We need to ensure that any changes don’t bring unknown risks, especially centralization pressures and economic incentives that could destabilize the network. Without these safeguards, adopting new proposals would be like navigating a minefield with a blindfold on.

Historical context: blocksize wars

Ah, the blocksize wars—a time when the community didn’t lose their collective minds over proposals, but instead engaged in thoughtful, open discussions. Those were the good ol’ days, when people actually thought things through, ran numbers, and engaged in meaningful debates. It wasn’t about making hasty decisions but deliberating over the smallest details to ensure nothing would go sideways.

Remember when Bitcoin XT was all the rage? Initially, I was a supporter too. But as more logical discourse and data came to light, I changed my mind. It's a testament to the rational skepticism that dominated that era. And that’s the kind of constructive dialogue we need to return to. People weren’t flinging “unknown unknowns” like the latest trend—no, they were diving deep into the consequences and implications of each proposal.

Fast forward to today, and what do we have? Knee-jerk reactions and senseless arguments hampering progress. This refusal to engage thoughtfully is essentially running a denial of service attack on the very essence of dialogue. You want to talk about a new change or a proposal? Boom! Here comes the “unknown unknowns” brigade, ready to shut down any and all conversation. That isn't caution—it’s sabotage. If Bitcoin is to evolve safely, we need to bring back that thoughtful, discussion-driven approach. Otherwise, we’re just spinning our wheels in the muck of irrational fear and stubbornness.

Rational Discourse vs Denial of Service

In recent years, the Bitcoin ecosystem has increasingly found itself in a tug-of-war between progressive innovation and staunch conservatism. Sound familiar, right? Since the activation of Taproot, we've seen a whirlwind of proposals, debates, and the occasional meme-laden Twitter battle. It's like watching a tech version of "Game of Thrones" where everyone has a strong opinion, but fewer dragons. Rational discourse is crucial for maintaining the integrity and future-proofing of Bitcoin, yet ironically, we've seen a strange rise in what could only be termed as a 'denial of service' attack on sensible dialogue.

This phenomenon isn't just an occasional nuisance; it's evolved into a profound barrier to effective conversations about Bitcoin's future. Certainly, there's a case for a conservative approach, as hasty changes could expose the network to unforeseen vulnerabilities. However, the constant knee-jerk rejection of any proposal by citing "unknown unknowns" or "the default is no change" has turned the dialogue into a tedious exercise. It's like trying to convince a cat that a bath is a good idea. Rational engagement is replaced with reflexive dismissal, often without entertaining the actual merits or pitfalls of the proposals.

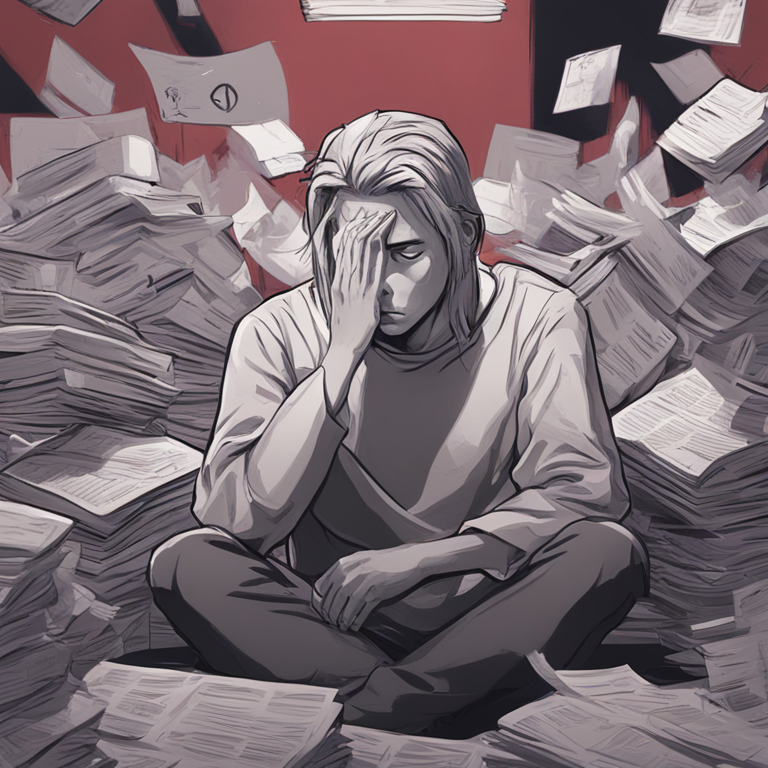

The Role of Fear and Misinformation

While we might chuckle at some of the absurdities we see online, the underlying issue here is far from trivial. Fear and misinformation play significant roles in shaping the Bitcoin discourse. Amid all the FUD (fear, uncertainty, and doubt), rational skepticism seems to have taken a backseat. Instead, there's a rampant spread of unfounded fears which are often amplified by those who refuse to learn or engage deeply with the material. Picture this: You're at a concert, and someone keeps yelling "Fire!" in the middle of a beautiful symphony, even though there's no smoke in sight. That's essentially what's happening.

Fear stems from a fundamental worry that any change could potentially lead to unintended consequences, and fair enough. No one wants the Bitcoin ship to hit an iceberg. But rational analysis means weighing risks against potential benefits, not just shouting "Iceberg!" every time someone mentions innovation. Unfortunately, in this noisy environment, the "unknown unknowns" card gets played as though it trumps all logic and evidence. This denies any meaningful conversation from progressing, let alone reaching a consensus that could be fruitful.

Future of Bitcoin Development Discourse

So, where do we go from here? Obviously, the current method of hijacking every conversation gets us nowhere. It’s like a never-ending family dinner debate where Uncle Bob just won’t stop talking about conspiracies. What Bitcoin needs is a return to thoughtful, evidence-based dialogue that respects the complexities and nuances of implementing changes. The focus should be on rational inquiry and understanding, rather than gut reactions and fear-mongering. In a universe where the economic majority truly understands the trade-offs and functionalities of proposed changes, the outcomes will undoubtedly be sounder and more resilient.

In conclusion, fostering an environment that prioritizes good-faith dialogues can dispel the shadows cast by irrational fears. This means countering misinformation with facts and encouraging curiosity over complacency. We need to make space for debates that aren't shut down by loud, impulsive vetoes but are instead guided by informed, balanced viewpoints.

Conclusion

It's crucial to reinvigorate rational discourse within the Bitcoin community. As clichéd as it may sound, it’s about striking a balance between innovation and caution. At the end of the day, neither denial of service on dialogue nor blind acceptance of change should have a seat at the Bitcoin development table. Instead, we should strive for conversations that are rooted in evidence, openness, and a shared goal of enhancing the network's resilience and functionality. Only then can we hope to navigate the complexities of Bitcoin development in a way that benefits everyone.

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.