Avalanche (AVAX) Price Rests at Critical Support Level for Next Move

- byAdmin

- 14 May, 2024

- 20 Mins

Introduction

Welcome to our deep dive into Avalanche (AVAX)! In today's analysis, we unravel the recent price actions of AVAX and explore its on-chain activity. The AVAX price is teetering just above a crucial $30 support level, giving many holders a case of the jitters! But hey, don't fret just yet. We've got the lowdown on the trends and potential future movements to keep you in the loop. So, buckle up for a blend of sharp insights and a sprinkle of humor to ease the tension!

AVAX Trading Analysis

Current Price Action

As of now, Avalanche's price is doing a delicate dance around the $32 mark. Picture a tightrope walker on a windy day and you've got the current AVAX situation. The 4-hour chart paints a vivid picture with red lines highlighting key support and resistance levels. A slip below the $30 mark—what we call the "falling-off-the-tightrope moment"—could trigger a cascade of liquidations. This would likely lead to further price depreciation, and nobody wants to see that. So, keeping an eye on this $30.74 level, near the 0.618 Fibonacci line, is crucial. A sniff below could spell trouble in crypto paradise!

Support and Resistance Levels

Now, let's talk shop about support and resistance levels. The $30.74 mark is akin to the final thread holding everything together; a breach below could result in a domino effect of sales. On the flip side, we've got some resistance titans to watch: $33.26 (200 EMA), $34.06 (100 EMA), and $39.78. These EMA lines don't just sit there looking pretty—they act as barriers in the bearish landscape that can make or break recovery attempts. One thing’s for sure, you don't want to be caught off guard here. Especially since breaking above the Ichimoku Cloud—a massive resistance zone—could signal better days ahead.

On-chain Metrics and Holding Behavior

Here's where things get extra spicy. The average holding time for AVAX has descended to lows reminiscent of the Q4 2022 bear market. This tells us one thing: investors are jumpier than a cat on a hot tin roof. Increased trading activity and reduced long-term confidence indicate a market operating under a storm cloud of volatility. The drop in holding time dials up bearish sentiments, leaving AVAX dancing in a sea of short-term trades. With over 2 million small holders at either break-even or losses, we might see a surge in selling pressures soon. This isn't just a random fluctuation—oh no, it's a calculated, albeit anxiety-driven response to market conditions.

Key Takeaways and Strategic Recommendations

Ready for some take-home nuggets of wisdom? Here's how the land lies. Right now, AVAX straddles a cusp between bearish and neutral outlooks, caught in the aftermath of Bitcoin's pullback from its highs. If Bitcoin manages to pump up the volume and head toward its peak, it could lend AVAX a much-needed hand. But—and it’s a big "but"—should Bitcoin falter, we could see AVAX struggling below that critical $30 support level. For those of you seeking to minimize risk: wait till AVAX dips below $30 before buying in. Aim for an entry within the $25-$27 bracket, set a stop loss at $24, and shoot for selling at $40-50 during the next upward wave. Trust me, your risk management strategy will thank you!

In a nutshell, things are shaky but not bleak. Stay informed, stay smart, and don't make any knee-jerk decisions. After all, even in the wild west of crypto, a bit of cunning can go a long way!

On-Chain Metrics

Average Holding Time

The average holding time of Avalanche (AVAX) has recently dipped to levels reminiscent of the Q4 2022 bearish phase. This shift isn’t just a coincidence; it suggests a significant behavioral pattern among investors. Instead of playing the long game, many are opting for quicker trades. Think of it as a switch from collecting fine wine to chugging soda cans—instant gratification over long-term benefits. This short holding tends to result in heightened market volatility, akin to the roller-coaster rides you both love and dread at amusement parks.

As investors prioritize shorter holding periods, it may signal a lack of confidence in AVAX’s long-term potential. Many are treating the asset more like a day trader’s delight than a savings bond. Naturally, when everyone is in a hurry, you get more car crashes on the road, right? This increased trading activity leads to frequent price swings, creating an environment where the faint-hearted might prefer to sit on the sidelines.

Small Holders Behavior

When we peek under the hood, we see that over 2 million small AVAX holders find themselves in a rather uncomfortable position—either breaking even or suffering losses. This predicament could turn these holders into panic sellers, further adding fuel to the fire and dragging prices down. Imagine a crowd rushing towards the exit of a concert when the first firecracker goes off; the chaos is real, and it’s a sight you don’t want to be in.

The distribution of AVAX holdings reveals that a vast number of addresses are clutching onto bite-sized chunks of AVAX, ranging from 0 to 10 tokens. This miniature-hoarder mentality, while cute in theory, spells caution in capital letters. These small investors are more likely to hit the panic button at the first sight of trouble, creating a domino effect that could lead to increased volatility and subsequent price depreciation.

Large Holders Stability

In contrast to their jittery, small-holding counterparts, the larger AVAX investors appear to be the stoic philosophers sitting in the park—unmoved by the daily hustle and bustle. Their holdings have remained relatively stable, suggesting a level of confidence that others envy. This steadiness provides a sturdy backbone to AVAX’s overall market structure, but even the strongest backbones can’t support a collapsing torso indefinitely.

The calmer sands of stability among larger holders mitigate some of the panic-induced volatility. Still, it’s the small holders who dictate the short-term ups and downs. While the big kahunas of the market stay put, the smaller fish continue to flip-flop, making the ocean of AVAX somewhat turbulent. This disparity in behavior highlights differing investment strategies and risk appetites within the AVAX community.

Short-Term Traders

One of the key insights from recent data is the significant drop in the number of AVAX addresses holding the asset for less than a month. This exodus of short-term traders could spell a reduction in immediate price volatility—think of it as fewer novice chefs in a chaotic kitchen, leading to slightly fewer accidents. But fewer short-term traders also mean less buying support, rendering the price more vulnerable to dips from other market segments.

The hasty retreat of these short-term traders reflects a broader sentiment shift: the market is in defensive mode. It’s like a football team pulling back to guard the goal rather than pressing forward to score. While this might offer temporary stability, it leaves AVAX more susceptible to downward shocks, particularly if larger market forces, like Bitcoin’s performance, take a turn for the worse.

Strategic Recommendations

Bearish to Neutral Outlook

AVAX is currently dancing precariously on the edge of the $30 support level, and it looks like it needs a confidence boost. This struggle comes on the heels of Bitcoin's correction from its all-time highs, spreading jitters among AVAX holders like bad karaoke. As short-term investors jump ship to avoid losses, the market sentiment leans bearish to neutral.

This isn’t to say doom is inevitable, but the market is clearly lacking the rosy optimism seen during bull runs. Investors are adopting a cautious approach, with many sitting on the sidelines, waiting to see if the school dance picks up or fizzles out. Meanwhile, AVAX's price remains susceptible to external influences, such as Bitcoin's movements.

Bitcoin’s Influence

Bitcoin is like the Beyoncé of the crypto world—its moves set the stage for everyone else. If Bitcoin continues its journey towards those dazzling all-time highs, it's likely to take AVAX along for the ride. On the flip side, should Bitcoin fumble and fall, AVAX could face a more challenging road, potentially dropping below the critical $30 support level.

For AVAX, the relationship with Bitcoin is akin to being tethered to a champion marathon runner. If the champ wins, everyone celebrates; if the champ collapses, everyone shares the gloom. This influence underscores the interconnected nature of the crypto market, where the fate of one heavyweight often impacts the entire ecosystem.

Conditional Support

The fate of AVAX hinges significantly on Bitcoin's performance over the short to mid-term. AVAX's critical support level around $30 serves as the thin line between cautious optimism and outright panic. Should Bitcoin falter further, pressing its own decline, AVAX may well find itself slipping below this crucial threshold.

Here’s the kicker: if Bitcoin stages a recovery, it could lift AVAX back into the safe zone, possibly igniting a renewed bullish sentiment. However, if Bitcoin continues its downward trend, AVAX could see a notable mid-term price decline, painting a less rosy picture for current holders.

Price Projections and Recommendations

In a bearish scenario where Bitcoin makes a mess of its own kitchen, AVAX could very well tumble to the $25 mark. A strategic play for investors would be to wait for AVAX to fall below $30 before swooping in for a buy. The ideal entry, hovering around $25-$27, offers a sweet spot for potential gains.

To manage risks effectively, setting a stop loss at $24 could save one from waking up to unpleasant surprises. And if a fairy-tale recovery does happen, aiming for a sell price between $40 and $50 could help maximize returns. This approach serves as a pragmatic roadmap through the unpredictable terrain of AVAX trading.

Crypto.com and Adan Association

Crypto.com has recently joined hands with the Adan Association, marking a significant milestone in the blockchain industry's collaborative spirit. Picture this: a pair of mega minds joining forces like Batman and Robin, but for crypto. This partnership aims to drive innovation and promote the growth of blockchain technology in France and beyond. By being a part of Adan, Crypto.com commits to contributing to policy-making, advocacy, and education efforts within the regional blockchain space. With over 50 members, Adan represents a diverse range of blockchain interests, from pure tech innovation to financial applications. So, it's like a superhero league for blockchain enthusiasts.

From policy-making to community events, both organizations will work together to ensure blockchain innovation gets the spotlight it deserves. Considering Crypto.com's significant user base, this partnership could be the crypto world's version of peanut butter meeting jelly — tasty, seamless, and full of potential. Additionally, the Adan Association's connections with governmental and institutional bodies will surely make navigating the murky waters of regulation a tad smoother for everyone involved. Expect great things and perhaps a spate of new blockchain initiatives springing up like mushrooms after the rain.

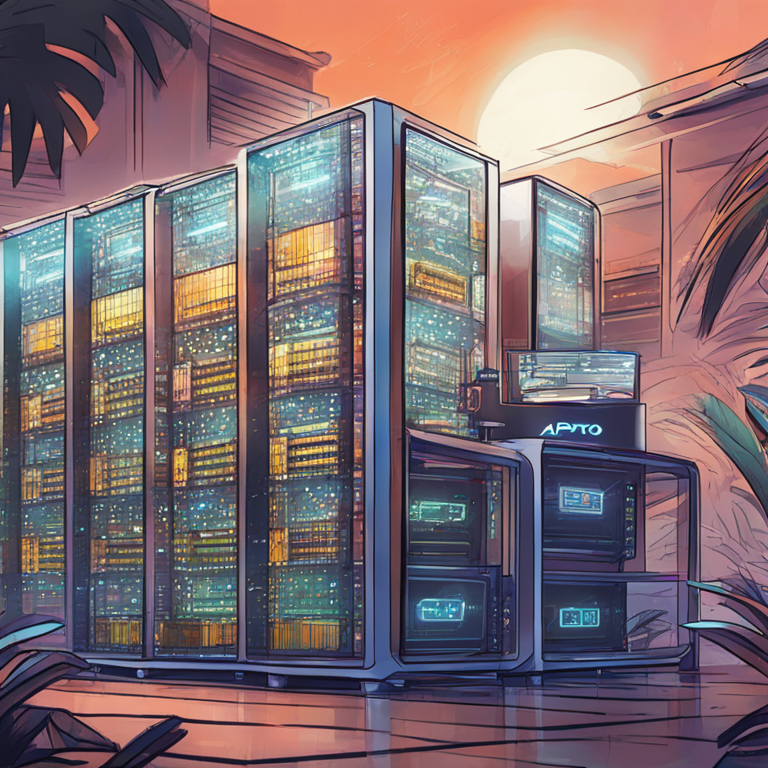

Aptos Blockchain Innovation

Hold onto your hats, because Aptos is shaking things up in the blockchain world with its new sub-second latency innovation. That's right — transactions that take less time than a hiccup! Aptos is pulling out all the stops to ensure a fee-free, lightning-fast DApp ecosystem, which could potentially revolutionize customer experience and usage metrics. Imagine deploying smart contracts or making transactions in the blink of an eye. That's what Aptos is gunning for.

This innovation is akin to swapping your old dial-up internet for fiber-optic broadband — a monumental leap. With such speed, developers can build more efficient and responsive decentralized applications (DApps), potentially attracting more users and subsequently bolstering the broader crypto ecosystem. Aptos aims to pioneer this transformation, proving that blockchain can be as swift as your favorite streaming service. So, if latency was the last thing holding you back from diving head-first into the blockchain sea, Aptos just threw you a floatie.

Pepe Coin Price Discovery

Shiver me timbers! Pepe Coin has entered the thrilling phase of price discovery, where fortunes are made, and well, some lost. For those not in the loop, price discovery is when a coin breaks new ground in determining its market value. Pepe Coin’s recent movements have left traders on tenterhooks, oscillating between joy and despair faster than you can say "blockchain."

Navigating this phase is akin to sailing through uncharted waters, where every ripple could signify a new price floor or ceiling. Traders and holders, armed with their technical charts and a gallon of coffee, are constantly on the lookout for price signals. Current speculations suggest potential new highs or corrections, making it an exhilarating time to be part of the Pepe Coin community. So, if you have diamond hands, now's the time to polish them!

Crypto Utilization Tips

Did you know your crypto can do more than just sit pretty in your wallet? Hold on to your hats as we dive into the lesser-known yet utterly fascinating tricks your digital coins can perform. Imagine being able to buy real estate, pay for education, or even subscribe to your favorite entertainment services with your crypto stash. It's like discovering your pet dog is actually Batman — surprising and immensely useful!

First up, real estate investments are becoming a staple in the crypto world. Platforms such as Propy allow you to purchase properties globally using popular cryptocurrencies like Bitcoin and Ethereum. Another gem is using crypto as collateral for loans or even earning interest through decentralized finance (DeFi) platforms. It's like putting your money to work while you’re on a tropical vacation.

Moreover, numerous educational platforms now accept crypto payments, enabling you to acquire new skills without the hassle of currency conversions. Some universities even accept Bitcoin for tuition fees! Finally, everyday services like food delivery, streaming subscriptions, and even online dating are starting to accept crypto payments. So, next time you're contemplating what to do with your digital coins, remember they're capable of much more than just HODLing.

Bitcoin Address Risks

In the realm of crypto, not all glitters is gold as more than 5.1 million Bitcoin addresses find themselves teetering on the edge amid Bitcoin's latest dip below $62,000. Imagine walking a tightrope but with less balance and more existential dread. These addresses are in precarious positions, with owners potentially facing substantial losses if the market doesn't bounce back soon.

Essentially, those who bought in at higher prices are now scrambling for cover or nervously watching the charts. The scenario underscores the volatile nature of the crypto landscape, where gains can evaporate quicker than water on a hot skillet. As such, strategy and careful planning become quintessential — setting stop-loss orders, diversifying portfolios, and staying vigilant can make all the difference.

Meanwhile, it's also clear that understanding market trends and having a keen eye on Bitcoin's performance can offer some peace of mind. Timing is everything in the crypto world. Hence, the key takeaway here is to stay informed, plan meticulously, and never underestimate the power of crypto whales in swaying the market. Got some popcorn? Because Bitcoin addresses are in for a wild ride.

Tether and RAK DAO Education Initiative

Get ready for a brainy blast as Tether teams up with RAK DAO to boost Bitcoin and stablecoin education in the UAE. This initiative is like a TED Talk but with a sprinkle of blockchain glitter, aiming to spread crypto knowledge far and wide. With sessions planned to cover everything from Bitcoin basics to advanced stablecoin strategies, it's an educational endeavor set to enlighten many.

The collaborative effort aims to demystify crypto and make nuanced topics accessible to all, from newbies to seasoned crypto vets. Picture classroom sessions mixed with engaging webinars, and maybe even a few animated infographics for good measure. The ultimate goal is to empower individuals and businesses in the UAE to understand and leverage crypto technologies effectively.

So if you've ever scratched your head over blockchain jargon or wondered how stablecoins could benefit your financial strategy, this initiative is your golden ticket. With both Tether and RAK DAO committing resources, it promises to be a comprehensive journey into the heart of crypto education, making sure everyone comes out the other side a little wiser and a lot more enthusiastic about blockchain's potential.

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.