Introduction

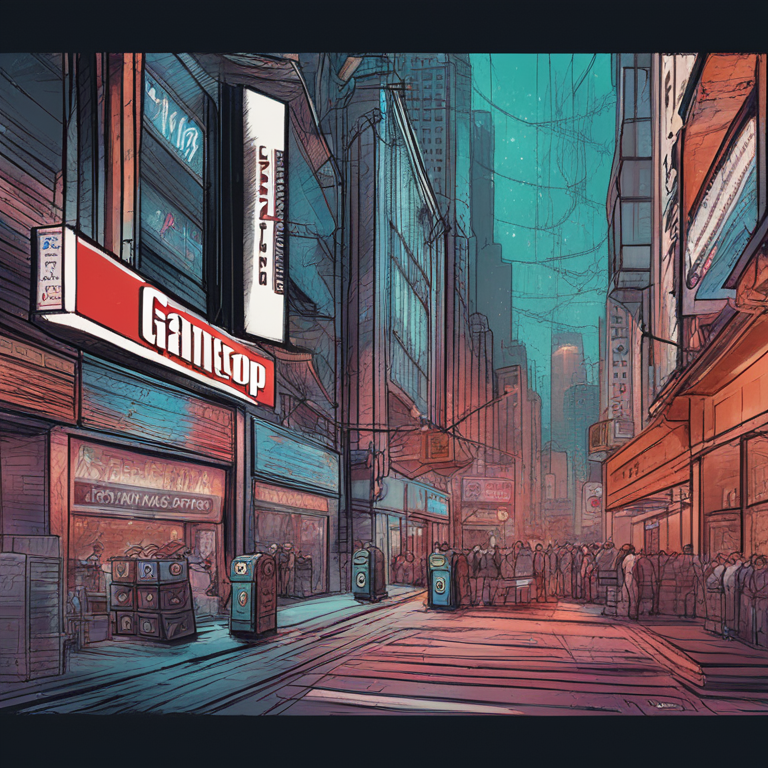

Wow, folks! Unless you were vacationing on Mars, you've probably heard the latest buzz in the financial world—GameStop (GME) has taken a nosedive. After a couple of mind-bending days of stock market gymnastics, GME shares plummeted by a jaw-dropping 30%. Is the Roaring Kitty rally running out of steam? Well, fasten your seatbelts because we're about to dive right into the nitty-gritty.

Background

To understand why the sudden drop is making waves, let's roll back the tapes a bit. It’s been almost two years since Keith Gill, better known as Roaring Kitty, spearheaded the spectacular Reddit-driven short squeeze that catapulted GameStop into financial folklore. The narrative was simple: rally the retail investors and take Wall Street for a wild ride. The strategy paid off big time, turning GME into a meme stock legend. Millions saw dollar signs, others just saw memes, and some saw both. Though Keith Gill went radio silent for a while, his recent re-emergence sent shivers of excitement through the financial community.

Recent Stock Events

Buckle up, because here comes the roller coaster part. On a quiet Friday, GME was lounging at $17.39 per share. Come Monday, with Roaring Kitty's electronic return, the stock sky-rocketed like it was launching to the moon, hitting an exhilarating $64.83 at its peak. However, like all good party tricks, the excitement didn't last forever. As of Wednesday morning, GME shares stumbled down to $34.12, marking a heart-wrenching 30% drop. All this chaos even led Nasdaq to hit the pause button six times before noon. But let’s keep it in perspective: despite the crash, the recent gains aren't completely evaporated yet. Other meme stocks, like AMC, felt the tremors too, dipping to $4.82 after previously touching $11.90. Even the GME Solana meme coin couldn't escape the downturn, dropping 23.9% in 24 hours after an all-time high. Meanwhile, FLOKI, a meme token named after Elon Musk's dog, managed to wag its tail with 17% gains. As the dust settles, it’s clear that the meme stock magic, much like internet fame, can be as fleeting as it is fabulous.

Impact of Roaring Kitty

Ladies and gents, buckle up because the wild ride known as "Roaring Kitty" is back in town, metaphorically messing with the stock market's hair just when it thought it had it all under control. Keith Gill, aka Roaring Kitty, is the legendary meme stock influencer, whose Reddit-fueled escapades gave the financial world a run for its money back in 2021. You might remember him as the guy who turned his humble investment in GameStop into a multi-million-dollar saga, leaving hedge funds panting in the dust. This mad lad has resurfaced like a cicada, popping out of the woodwork after years of silence, and oh boy, did he stir things up! His reappearance caused GameStop's stock to soar to dizzying heights, almost hitting $65 – a mind-boggling quadrupling of its price in just a few days. However, the reality check hit fast, and now it seems the stock is crash-dieting, dropping 30% to around $34.12. The question on everyone's lips is: Is the Roaring Kitty rally over, or are we just in the eye of the storm?

Market Reaction

Let's talk about the market's reaction – which is right now like a cat on a hot tin roof, skittish and unpredictable. The market opened with a bang, or rather, a thud, as GameStop's stock took a nosedive. Investors have been left clutching their pearls, watching helplessly as their recent gains evaporated into thin air. The Nasdaq had to step in and halt trading for GameStop six times (yes, you read that right) before the clock even struck 11 a.m. EST. Before all this hullabaloo, GameStop was sitting pretty at $17.39. But then Roaring Kitty made his grand entrance, and prices peaked at an eye-watering $64.83. Some savvy traders who played their cards right are probably sipping their piña coladas on a yacht right now, having turned a modest $27,000 into a cool $2 million by betting on GameStop’s meteoric rise. Others are left licking their wounds, wondering if it's time to pack it up or double down in this high-stakes game of stock market roulette.

Other Meme Stocks

But wait, there's more! Roaring Kitty's magical touch didn’t just mess with GameStop. It gave a nice shin-kick to other meme stocks too. Take AMC, for example – a theater chain that's been trying to stay relevant in the age of Netflix and home theaters. Once a darling of Roaring Kitty’s followers, AMC saw a similar crash-landing, plummeting 30% to $4.82 after enjoying a brief renaissance at $11.90. And then there's GME, a Solana-based meme coin that decided to hop on this wild roller coaster ride. Inspired by the GameStop short squeeze saga, GME peaked and then promptly dropped like a rock, falling 23.9% in the last 24 hours. On the flip side, Floki Inu (FLOKI), a meme coin that takes its name from Elon Musk's adorable Shiba Inu, was soaring with 24-hour gains of 17%. How’s that for a twist? It’s like watching a reality TV show where one day you’re in, and the next day, you're out, along with your portfolio's value. The current scenario is as unpredictable and thrilling as an episode of a daytime soap opera, making it hard to predict what the next big plot twist will be.

Crypto Market Influence

After seeing GameStop (GME) take a bungee jump of a lifetime, dropping 30% in mere minutes, one can't help but reflect on the tumultuous relationship between meme stocks and the broader crypto market. Just a few moments ago, GME was the shining star on Wall Street, thanks to Roaring Kitty's digital fanfare. However, this feline rally seems to have a bit of a hairball situation.

Is the Roaring Kitty rally over? Well, the Nasdaq certainly thinks so—it hit the emergency brakes on GME trading six times before the rest of us finished our morning coffee. Despite the plunge, the stock still hasn't given back all its recent gains. It's holding onto some of the glitter it acquired, just enough to keep speculative traders on their toes.

Before Roaring Kitty's latest internet escapade, GME closed at a humble $17.39 on Friday. Fast forward to the resurgence, and the stock hit a waltzing high of $64.83—talk about a meteoric rise! That's not something you see every day in the traditionally buttoned-up realms of Wall Street. Momentarily, lucky traders might have cashed in enough to rival their own lottery winnings.

So, what about the rest of the curiosity cabinet? AMC, another stock previously charmed by Roaring Kitty’s touch, is also following GME's descent, plummeting by 30% for the day. Even the Solana meme coin themed after GameStop has taken a nosedive, shedding 23.9% of its value in the past 24 hours. Apparently, the nostalgia of 2021's great short squeeze isn't quite enough to sustain these trendier-than-thou investments.

Interestingly, the crypto market isn't all stormy weather. Floki Inu (FLOKI), named after Elon Musk's fluffy Shiba Inu, has been catching some bullish waves, riding a 17% 24-hour gain. It's an "aww"-worthy twist because Roaring Kitty’s recent social media clues hinted at the "dog days" being over. Irony has a funny way of showing up uninvited, doesn't it?

As the meme stock circus continues to pitch its tent, one can't help but wonder about the future of these volatile darlings. Are we looking at the last act of the Roaring Kitty spectacle, or is this just another breathtaking leap in the ongoing acrobatics of stock market shenanigans? Only time—and perhaps another perfectly timed meme tweet—will tell.

Conclusion

The GameStop drama, akin to a blockbuster movie, has once again reminded us of the intricate dance between meme stocks and the crypto market. While today's drop suggests the Roaring Kitty rally may have quieted down, the crypto world continues to boast its own set of spectacles. In this ever-evolving financial theater, fortunes can be made or evaporated in the blink of an emoji. So, keep your notifications on and your strategy flexible—because who knows what meme magic tomorrow might bring?

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.