Bitcoin Hashrate Decline Signals Miner Capitulation After 4th Halving

- byAdmin

- 15 May, 2024

- 20 Mins

Introduction

Imagine your job pays you less and less as time goes on, and you think to yourself, "This gig is not worth it anymore." That's kind of what's happening to Bitcoin miners after the cryptocurrency's fourth halving event. When these guys start hanging up their mining hats (or helmets? What do miners wear?), it causes a domino effect in the crypto world. We've seen a decline in Bitcoin's hashrate, according to analysts, and it has enough implications to make us all sit up and pay attention.

Observations Post 4th Halving

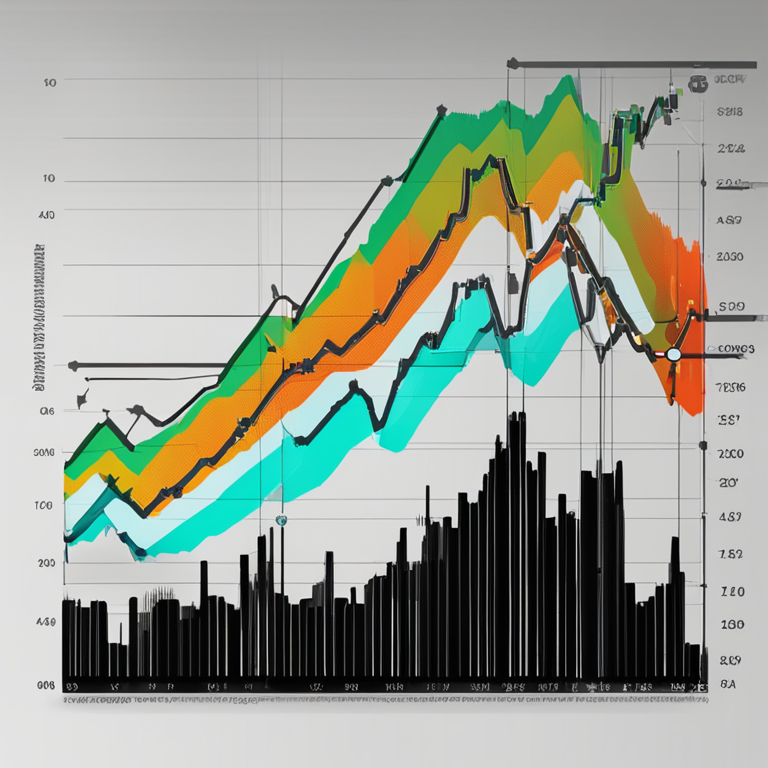

So what's the buzz about? Well, a CryptoQuant analyst recently noted that Bitcoin's 30-day moving average hashrate fell from a peak of 630 EH/s (that's a lot of computer power, folks) down to 606 EH/s. Now, in the typical post-halving world, we would expect this number to go up, up, and away. But not this time. The hashrate has decided to take a chill pill, diverging from its usual pattern.

Is this a big deal? You bet your digital wallet it is! The infamous Hash Ribbons indicator, which has had a long-standing relationship with miner capitulation, flashes a big, green warning light whenever the hashrate tumbles. The logic here is simple: when the computational power behind Bitcoin drops, it often means miners less capable of keeping up with the reduced rewards are calling it quits. And guess what? Their exit stage left often means they're selling off their freshly mined Bitcoin to cover the bills. This can stir up quite the storm in market dynamics.

Looking at some graphics shared by our friends at CryptoQuant, the periods where hashrate takes a nosedive are often marked in green on Bitcoin price charts. These "green zones" of capitulation signal times when the less efficient miners are bowing out. Essentially, this is like watching marathon runners drop out of the race when they realize a sprint finish just isn't in the cards.

Okay, but what does this mean for Bitcoin's price? Glad you asked. Miner capitulation may initially push Bitcoin prices down, but here's the kicker: the Hash Ribbons indicator suggests these are often precursors to major price lows. Translation? Savvy investors see this as an opportunity to swoop in and buy Bitcoin at a discount. It's like a Black Friday sale but for digital gold.

Bear in mind, though, that these effects don't unfold instantly. Think of it like watching a slow-cooking stew; it takes time to get all those rich flavors. The downward pressure and subsequent opportunities typically play out over days and weeks, not minutes.

In conclusion, as the crypto community continues to keep an eagle eye on Bitcoin's hashrate and post-halving fluctuations, it's clear that miner behavior and Hash Ribbons insights are critical puzzle pieces. Despite the short-term turbulence, the long-term outlook of Bitcoin continues to shine bright—perfect for those who like their investments with a side of wild roller-coaster thrills.

Halting Hashrate and Miner Capitulation

Hold on to your crypto wallets, folks! One month after Bitcoin’s fourth halving event, we've got some juicy insights about Bitcoin’s hashrate, the holy grail indicator of miner sentiment. If you're not familiar with it, think of hashrate as the Bitcoin network's heartbeat, and right now, it’s showing signs of arrhythmia! According to CryptoQuant, the 30-day moving average of Bitcoin’s hashrate has dipped from its high of 630 exahashes per second (EH/s) to a more modest 606 EH/s. This isn't your typical post-halving behavior—usually, we see hashrate climbing like a rollercoaster on its way to the top.

The buzzword here is "miner capitulation," brought to you by the good folks who swear by the Hash Ribbons indicator. It's like the cryptoverse’s version of a canary in a coal mine. When the canary calls out, it often means some miners are throwing in the towel, turning off their supercomputers, or relocating to greener (and cheaper) energy pastures. This often means they’re also selling some of their Bitcoin to make ends meet, which may send ripples through the market.

Graphically speaking, Bitcoin price charts showing these rapid hashrate declines look like a disco floor from the 70s—flashes of green marking miner departures. And this "miner capitulation" isn’t just for show; it signifies a reduction in the computational brawn securing the Bitcoin network. Ah, the bittersweet symphony of less efficient miners calling it quits. But don’t cue the violins just yet; there’s more to the tale!

Hash Ribbons Indicator and Implications

Moving on to the star of our show: the Hash Ribbons indicator. While it might look like some mystical crypto rune, this indicator is a pretty nifty tool for anticipating price trends. When the hashrate takes a nosedive and miners begin capitulating, it often spells doom and gloom for Bitcoin prices—at least temporarily. But, and this is a big BUT, it also sets the stage for some rock-bottom price points that savvy investors drool over. Think of it as the Black Friday of Bitcoin price dips.

However, don’t start texting your stockbroker just yet. The effects of miner capitulation are like that one friend who’s always “on their way” but shows up fashionably late. The repercussions usually unfold gradually over the following days and weeks. It's a waiting game that tests even the steeliest nerves in the crypto sphere.

As everyone continues to eye Bitcoin’s hashrate and market behavior post-fourth halving, insights from our trusty Hash Ribbons provide the much-needed context. They help decode the enigmatic behavior of miners and their domino effect on Bitcoin prices. Sure, there may be some turbulent short-term fluctuations, but the broader resilience and future prospects for Bitcoin look as solid as ever. The blockchain community might endure a few bumps, but the marathon isn’t over.

Miner capitulation and Hash Ribbons connection

So, you know how the most thrilling storylines offer unexpected plot twists? Like when your favorite movie character flips from hero to antihero? Well, the crypto world's latest drama involves Bitcoin miners and the Hash Ribbons indicator—a tale with more suspense than the latest Netflix thriller.

Let's break it down. After Bitcoin's fourth halving—think of it like your boss cutting your paycheck in half but promising double the benefits later—everyone had their eyes glued to the hashrate. According to a CryptoQuant analyst, the average hashrate dipped from 630 EH/s to 606 EH/s. This drop wasn't just a blip; it was a blaring siren blaring louder than your neighbor's car alarm at 3 AM.

The Hash Ribbons indicator, our crypto soothsayer, connects these dips with "miner capitulation." Picture this: miners who aren’t quite the marathon runners of the crypto race realize they can't keep up. They either throw in the towel, relocate to crypto-friendlier pastures, or offload their newly minted Bitcoins to cover their ever-rising operational costs—kind of like a yard sale where everything must go, pronto!

Graphs juxtaposing Bitcoin's price movements with hashrate fluctuations show these periods in green, symbolizing miner doom and gloom. Essentially, these episodes are when less efficient miners hit an existential crisis and decide to call it quits, reducing the overall computational power dedicated to securing the Bitcoin network.

Now, you might wonder, "Is this all doom and gloom?" Well, not exactly. There’s a twist—our good old Hash Ribbons indicator suggests that miner capitulation often precedes significant price lows. Translation: savvy investors with a keen eye can spot buying opportunities like beachcombers finding lost treasure.

However, this isn’t a quickie affair. The effects of miner capitulation unfold gradually, stretching over days and weeks. So, patience, young padawan. While observing Bitcoin’s hashrate and market dynamics post-halving, insights from indicators like Hash Ribbons are invaluable for understanding miner behavior and price predictions.

In summary, while miner capitulation may initially paint a grim picture, it's a tale of resilience, rebirth, and long-term optimism. Keep your popcorn ready; this story isn’t over yet.

Conclusion

Deep in the heart of the crypto jungle, miner capitulation stories and the Hash Ribbons indicator offer a blend of intrigue and opportunity. It’s a dance as old as Bitcoin itself—miners entering and exiting the stage, shaping the narrative one hash at a time. By keeping an eye on key indicators and understanding these patterns, investors can become the heroes of their own financial sagas. So, keep your charts close, your spirits high, and remember: in the world of Bitcoin, the next exciting twist is always just around the corner.

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.