Introduction

Guess what, crypto enthusiasts? Russia's parliament, the State Duma, is bringing the hammer down on cryptocurrencies. But before you panic and start burying your digital wallets, let's dig into what this new regulatory bill is all about. The lawmakers are getting serious about tightening control over the previously free-wheeling crypto market by proposing a wide-ranging set of rules and restrictions. Let's break it down so you won't be left in the dark.

Russia's Crypto Regulatory Bill

State Duma's Involvement

The State Duma, Russia’s lower chamber of parliament, is at the helm of this crypto crackdown. No, they’re not trying to crash your crypto party—at least not entirely. The bill they're debating is like a guest list for an exclusive event, only allowing certain ‘verified’ participants to mine and trade those digital assets. This initiative isn't out of the blue. Russia’s financial bigwigs, including the finance ministry, the central bank, and the country’s financial monitoring service, have all thrown their weight behind the bill. The aim is to get it passed before the State Duma wraps up its spring session. Time to suit up your crypto knowledge, because things are about to get official.

Summary of the Bill

This bill reads like a crypto enthusiast’s worst nightmare or a regulator’s dream come true. Come September 1, 2024, the creation and circulation of cryptocurrencies will be banned—except for a few chosen ones. Only Russian registered enterprises can legally mine, provided they’re all listed in a special government register. Think of it like an elite club for crypto miners. Private individuals can still mine as long as they stick to strict energy consumption regulations, which may turn mining into a bit of a chore. Also, crypto advertising and circulation are a no-no. All mined crypto must be reported to the tax office, including the addresses where these cryptos are stored. The government’s reasoning? To prevent money laundering, terrorism financing, and other nefarious activities. That’s a lot to digest, huh?

Exceptions and Restrictions

If you thought a few rules couldn’t hurt, here’s where it gets interesting. There's a clause for exceptions, but it’s tighter than your grandma's purse strings. Officially registered enterprises can mine crypto, but they have to adhere to Russia’s central bank’s approval. Individual miners have some breathing room but come equipped with energy consumption restrictions. Oh, and almost forgot—they can ban mining in certain parts of the country outright. Electricity companies are sighing with relief; finally, they'll have justification against high-residential power consumers who hinder the grid. Private miners who sneakily connect to the national grid? They could be prosecuted and face steep fines. The goal? Avoiding those annoying power disruptions caused by crypto-loving freeloaders. And just so you know, despite the buzz about banning all crypto activity, an official statement from a Russian lawmaker clarified they’re not planning to outlaw crypto turnover entirely. Looks like some media outlets went a little wild with their headlines. Who knew?

Impact and Implications

Alright, crypto enthusiasts and digital miners, buckle up! Russia is shaking things up in the world of cryptocurrencies with a new regulatory bill that feels like putting a puzzle together on a roller coaster. The lawmakers of the State Duma are cracking down harder than a grandma on loud music. This new move promises a comprehensive ban on cryptocurrency circulation, except for those special kids in the class—officially registered miners and projects that win the central bank’s nod.

But don't start packing up your rigs just yet. The plan is to keep the Russian crypto mining game exclusive, allowing only registered businesses and individual entrepreneurs on the block list to mine. Private individuals are still allowed to be part of the action, but they’ll have to play by the government’s energy consumption rules, which might make their mining rigs as welcome as a bull in a china shop. So if you’re mining in your basement, keep reading to find out how these changes might affect you.

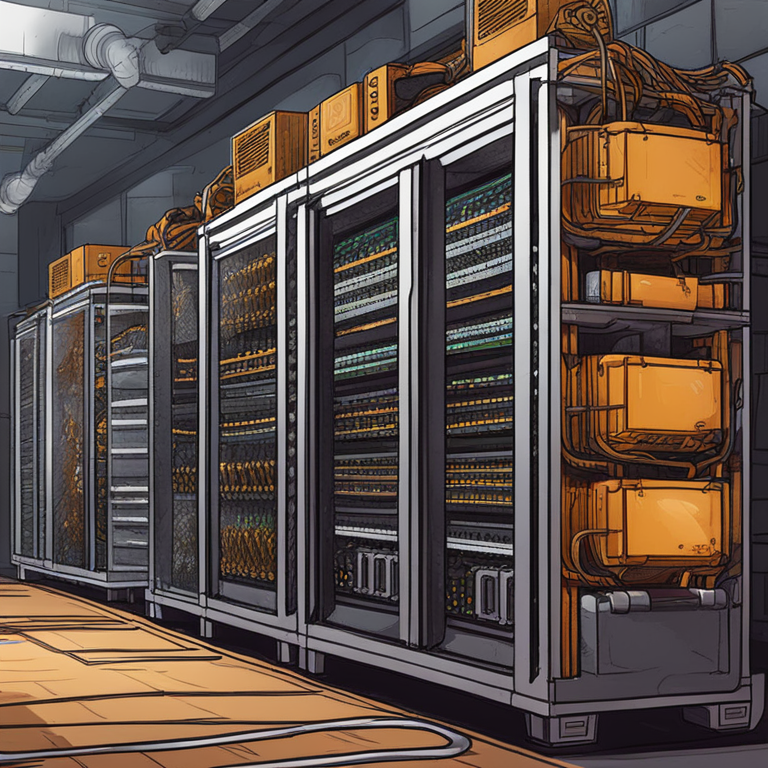

Effect on Mining Activities

First things first, let’s talk about the elephant in the room: mining activities. The new bill says that only Russian companies and individual entrepreneurs listed in a purposed special register can mine cryptocurrencies. It's like being allowed into the party only if your name is on the bouncers' list. Those who stay underground might find themselves forced to power down—or face the wrath of compliance officers.

Private persons, on the other hand, can still participate in cryptocurrency mining but with a catch: they have to follow strict energy consumption regulations. You can't just plug in and drain all the juice. These regulations could discourage amateur miners, much like a fitness regime on New Year’s Day—enthusiastic but hard to maintain. For many small-time miners, this new regulation could feel like a tight leash around their necks. It may push them to throw in the towel or look for greener, more lenient pastures abroad.

Energy Consumption Regulations

You may be wondering, “What’s the big deal with energy consumption regulations?” Well, the bill aims to tackle the issue of crypto miners using residential homes to power their mining operations, which has been causing power disruptions in certain areas. The government clearly doesn't want any part of mining turning into a game of hide-and-seek with the national grid.

The new regulation will impose penalties calculated using commercial rates—basically, you'll be paying like a big industrial fish, even if you’re just a small fry. If you're over-consuming energy in your residential setup, expect a hefty fine that’ll make you wish you’d stuck to regular hobbies like stamp collecting or knitting.

The authorities are not messing around. They've been clear that they will crack down on anyone caught red-handed connecting to the national grid unlawfully. This move might force miners to consider 'getting legitimate' or, as some might say, “go big or go home.” It’s an all-in bet where the stakes involve avoiding massive fines or relocating to another country altogether.

Tax Reporting Requirements

Here’s another wrinkle to iron out: tax reporting requirements. The bill mandates that Russian miners will have to report every single crypto coin they mine to the tax office. And it doesn't stop there—they also need to disclose the crypto addresses that got the shiny new digital currency.

The intent, according to the bill’s cheerleaders, is to avoid these funds from being used for unsavory activities like money laundering, financing terrorism, or other nefarious deeds. Essentially, they want to keep these coins clean as a whistle.

For miners, this means more paperwork, more compliance checks, and potentially more headaches. It’s like doing taxes but on steroids. Anyone who’s tried navigating tax forms will know the pain. The authorities hope that all these compliance measures will encourage miners to stay ethical, but whether they’ll succeed or just drive everyone nuts remains to be seen.

Government Actions and Reactions

Ministry of Finance's Stance

Alright, let’s zoom in on the Ministry of Finance’s stance here. They were the ones pioneering the idea of prohibiting organizing cryptocurrency circulation, leaving some breathing room only for stablecoins and the sales of coins by miners. Think of it like banning all but a handful of sports in a sports-mad country.

Despite the push, their plans hit a roadblock with Russia’s secret service. According to sources, the FSB and the investigative committee tripped up the initiative faster than you can say “blockchain.” The Finance Ministry plans to see this bill through by the State Duma's spring session conclusion, making sure the crypto space has the same clarity as a well-drafted tax code.

The Ministry is eyeing the crypto miner registry as their secret weapon to help identify if those hefty amounts of electricity are going toward legitimate business activities. So, if you’re a miner, keeping your activities above board is more crucial than ever.

Authorities' Push for the Bill

On top of all that, the authorities are adding fuel to the legislative fire, pushing this bill like it’s an ice cream truck on a hot day. Russia's lawmakers are racing to wrap this up, eager to bring a curtain down on the unregulated crypto show as soon as possible.

This flurry of activity is seen as a reaction to sanctions following the Ukraine war, which disrupted the crypto-based overseas transactions and sent lawmakers scrambling. If you detect a sense of urgency here, you’d be right—it's a priority mission as crucial as stabilizing their own currency.

The combined efforts of the Finance Ministry, Central Bank, and other regulatory bodies indicate that Russia wants to plug all the loopholes and bring the crypto joystick under government control. The days of freewheeling crypto might just be numbered, at least within Russian borders.

So, if you’ve been dabbling in the world of Russian cryptocurrencies, it’s time to take note. These new regulations will probably change how you operate, like switching from a manual to an automatic gearbox while driving. The sandbox might get a little smaller, but playtime isn’t over—yet.

Future concerns

Ah, the future, always delivering surprises even better than a box of chocolates! With Russia's latest move to take a hard stance on cryptocurrency through a new regulatory bill, the party atmosphere in the world of digital assets is about to be gatecrashed by some legalese. Whether you love or despise cryptocurrencies, you can't help but wonder about the future ramifications this will have on various stakeholders, including the miners, investors, and general users.

First off, Russian authorities seem to be rolling out this legislation like a red carpet—albeit one leading to a courtroom rather than a glamorous movie premiere. The bill aims to control and monitor all crypto activities, with miners now required to register and submit all the mined cryptocurrency details to tax offices. While this might sound like a simple visit to your local DMV, let's be honest; it's more like navigating a labyrinth with a blindfold on.

Potential miner relocation

Given all these regulations, do you blame miners for contemplating relocation like they're planning the next season of 'The Amazing Race'? Russia has always been a hotspot for crypto miners largely due to its cold climate and relatively cheap electricity. However, the new stringent measures could see miners voting with their feet. They might head to friendlier pastures—maybe Kazakhstan, Belarus, or heck, even Texas!

This exodus won't just be a minor inconvenience. Moving mining operations is not like packing for a weekend getaway; we're talking substantial logistics and cost. It's akin to moving an entire city's worth of infrastructure. Plus, if enough miners move out, it could affect the global cryptocurrency network itself—think of it like pulling out critical blocks from a Jenga tower. The whole arrangement becomes unstable.

Penalties for unlawful mining

For those who think they can outwit this bill by going the shadowy route, good luck! The Russian government, it appears, is ready to tackle illegal mining with the zeal of a watchdog. They’re proposing severe penalties for unlawful mining activities, notably targeting those who stealthily tap into the national grid. Imagine being a private miner and suddenly finding your electricity bill resembling the GDP of a small country—welcome to your worst nightmare!

This isn’t just a slap on the wrist; it's more like a financial cuffs-and-straight-to-jail approach. If private miners are caught breaching consumption limits, they won't just face hefty fines. These fines will be calculated based on commercial rates, implying you’ll be paying as much as big industrial players. Yikes! That’s like being charged five-star hotel rates but receiving a flea-infested motel room.

Clearly, the Russian government is serious about curbing illicit activities, and this could serve as a blueprint for other nations struggling with unauthorized crypto mining. So, if you’re in the crypto business, better ensure your operations are as squeaky clean as a whistle—or prepare to dig deep into your pocket (and we don’t mean for another mining rig).

Conclusion

So, what’s the takeaway from Russia's new crackdown on cryptocurrencies? In short, things are about to get very interesting. With stringent regulations looming, including hefty penalties for non-compliance, miners might well be packing their bags for more crypto-friendly locales. And let's not forget the ripple effects this could potentially have on global cryptocurrency networks.

While the bill seeks to bring order to the wild west of crypto trading and mining, it also inserts a hefty dose of legal and financial responsibility. Whether this move will bring stability or simply push the problem underground remains to be seen. One thing's for certain: the landscape of cryptocurrency is changing as fast as a tweet can spark a crypto crash. Stay tuned, folks!

Ethan Taylor

Ethan Taylor here, your trusted Financial Analyst at NexTokenNews. With over a decade of experience in the financial markets and a keen focus on cryptocurrency, I'm here to bring clarity to the complex dynamics of crypto investments.